Important Headlines

📰 Path Cleared for Argentina’s Acceptance into BRICs

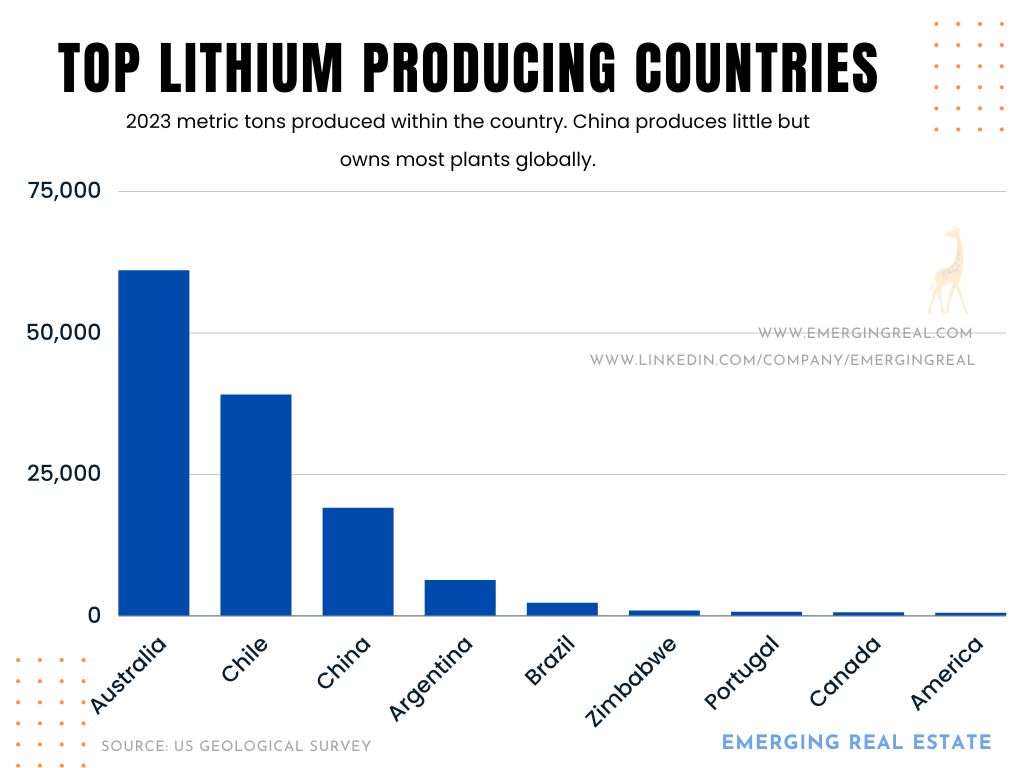

Simultaneously, Argentina is busy renegotiating a $44 billion program with the IMF. Brazil is pitching in to help Argentina cover the shortfall of joining fees. Chinese miners are investing billions of dollars in Argentina to exploit the country’s lithium for its thriving EV business back home. We’ve previously written about LATAM’s lithium potential and China’s diplomatic dominance of Washington DC in Argentina, and the region.

📰 Kentucky Firm Investing $200 Million in Mexico Tequilla Operation

Brown-Forman last week announced plans to expand its Casa Herradura tequila distillery in Jalisco to meet rising American consumer demand for premium tequillas. The $5 billion revenue firm purchased the distillery in 2007. The Louisville company owns brands such as Jack Daniel’s, Woodford Reserve and Old Forester.

📰 Uruguay’s New Foreign High-Net-Worth Investors Are Two-Thirds Argentinean

Sometimes referred to as the Switzerland of the Americas, Uruguay is a natural release valve for Argentina’s wealthy. Commercial real estate projects seeking funding should perhaps add Montevideo to its list of cities to visit.

📰 Greystar’s Origin Story in Chile

The largest rental unit owner in the world, Greystar, entered Chile in 2021 through a JV with Ivanhoe Cambridge, a Canadian firm with more than $70 billion in real assets. The investors see growing demand in part from the nearly 1 million migrants which flood into Chile annually from such places as Venezuela and Peru. Chile has a GDP per capita of $16,000 which is the highest in South America, but much lower than where these institutional developers are used to operating. We’ve written about large American investors’ experiences in Mexico’s multifamily sector.

📰 Brazil’s 3rd Largest Pension Fund Divesting 94 Properties by 2025

The properties slated to be sold by the $19 billion pension fund are land, shopping malls, and hotels.

📢 Announcements

New Emerging Real Estate Insights and Podcasts

💡 Mexican Multifamily: An Opportunity for American Institutional Investors?