Important Headlines

📰 Central Banks of Brazil, Chile and Mexico Combating Respective Presidents

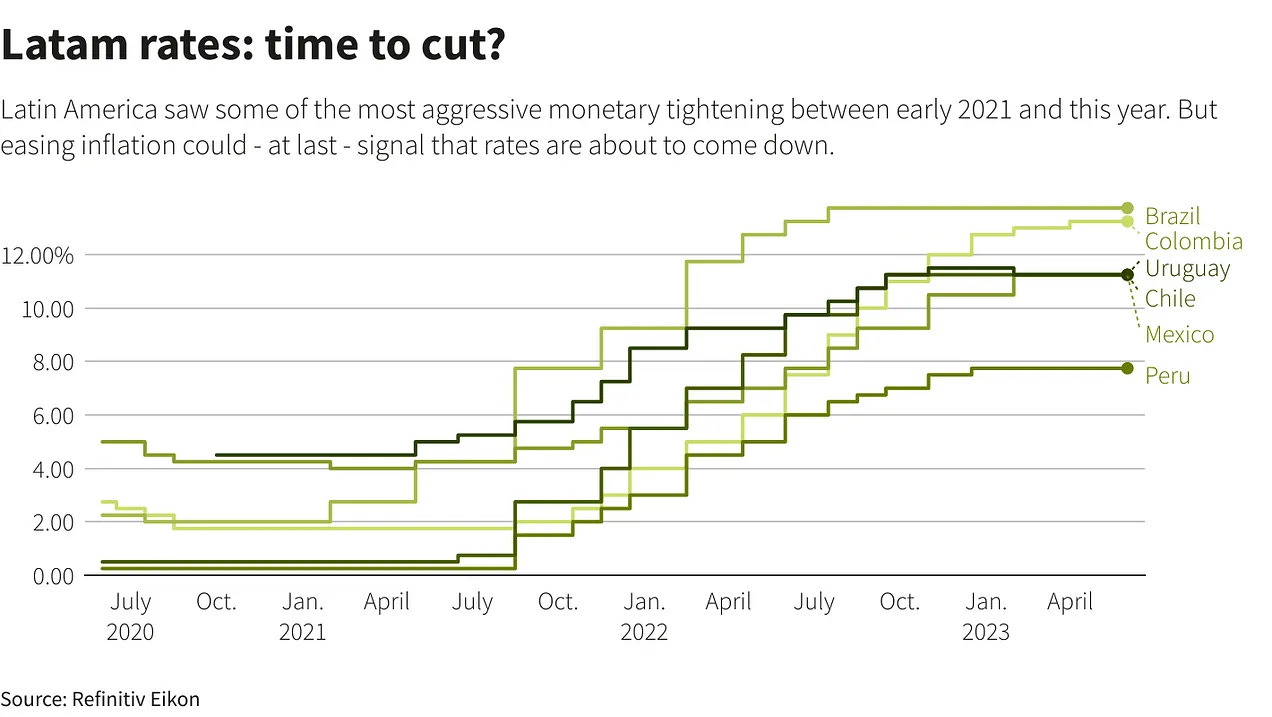

Between 11% and 13.7%, Brazil, Chile and Mexico have some of the highest interest rates in the world and in the region. They are also predicted to fall last in the region due to the central banks using high interest rates to contain the respective Presidents’ spending powers. High interest rates have a negative impact on domestic entrepreneurial activity, but also curtails government spending since borrowing costs are high and tax collection curtailed due to the economic malaise which results.

📰 Brazil’s Real Estate Funds Increasing Exposure to Shopping Centers

Brazil’s stock exchange has grown 11% year-to-date, being outpaced by the 18% growth of shopping mall funds on the index during the same period. Over the last 12-month period the shopping mall funds have gained nearly 30%.

📰 Mexico’s Peso Strength Represents Opportunity for Rest of LATAM

Decoupling from China, and rebuilding supply chains, is a process that is only just beginning. Mexico has been a primary beneficiary of the American initiative but is already being overwhelmed and the peso strengthening is evidence. Mexico doesn’t have a favorable regulatory environment and its leaders aren’t doing much to grow the nearshoring opportunity for itself. Many experts are saying Mexico has already missed the opportunity and will only receive a fraction of the benefits it could have.

📰 Brazil Received 41% of FDI into LATAM in 2022

41% of FDI flows in the region, which totaled $250 billion, went to Brazil, followed by Mexico which received 17%. Services accounted for the largest share (54%), followed by manufacturing (30%) and natural resources (17%). Coal, oil and gas investments increased significantly indicating that ESG’s antigrowth ideology has lost steam in the region.

📰 Colombia’s Proptech Sector Shines

Mexico and Brazil lead LATAM in terms of proptech, and Colombia is also a force with at least 200 startups in the field having collectively raised over $1 billion in capital. Habi is the unicorn of the bunch having raised $300 million last year alone. 60% of the proptech startups are in Bogota, the rest in Medellin. 60% of the funding is from American VCs, followed by Mexico-based VCs, and a smaller amount from Colombian VCs and accelerators.

Reader’s Insights (Podcast)

This week we interviewed Roberto Jimenez-Ramos, an architect based in Mexico City. During these ~10-minute interviews, we always ask the same three questions:

What is one thing people don't understand correctly about your industry that they should? Why does it matter? [Industry question]

Describe a skill or trait that has aided you throughout your career. How did you discover and foster it, and how has it helped you? [Career question]

How do you stay consistently motivated and hungry to improve yourself and your business? [Philosophy question]