Weekly Roundup | 9.26.2023

Top headlines and news impacting Latin America, Africa and Southeast Asia commercial real estate.

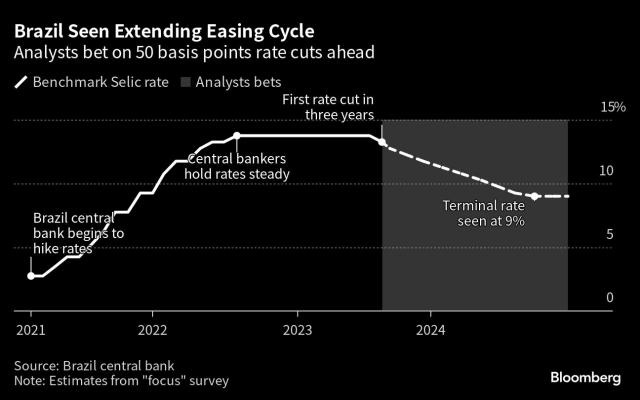

📰 Brazil Cuts Rates Again, This Time 50 Bps

Brazil’s central bank has reduced its interest rate by .50 percentage points bringing it down to 12.75%. Inflation expectations for Brazil are 4.9% (2023), 3.9% (2024) and 3.5% (2025). Target inflation is 3.18%. Cuts are expected to continue and to level off at 9%.

📰 Mexico’s Largest REIT to Spinout Industrial Portfolio

FIBRA Uno’s decision to create another FIBRA (i.e., REIT in Mexico) to hold its industrial portfolio is good for current shareholders and will create the largest industrial focused REIT in the country. The spinout is a sign that the REIT believes it has created all the value it can for its shareholders in the industrial sector. Emerging Real Estate Digest has warned recently that Mexico’s industrial sector is likely the largest bubble in Latin America real estate.

📰 Colombia’s Largest Retailer Lists Shares on the NYSE

The largest retailer in Colombia, Exito, has made history by being the first Colombian company to be listed in America and Brazil simultaneously. The move could provide more liquidity for the retailer to counterbalance the thinly traded nature of the Colombian stock exchange. The company’s float increased to 53% from 3.5% to meet the more rigid requirements of the New York Stock Exchange.

📰 Mexico’s Skyscrapers Are Getting Taller

Mexico’s first skyscraper was built in 1956 and is the 204-meter Torre Latinoamericana in Mexico City. In 2017, the KOI Tower in the San Pedro Garza García area of Monterrey, became the tallest skyscraper in Mexico at 279.5 meters high. In 2020, it was displaced by the Torre Obispado (photo below) in the same city. At 305 meters high and 62 stories, it is currently the tallest building in Latin America. Mexico City holds 46% of Mexico’s skyscrapers, and Monterrey 27%. Mexico has 160 skyscrapers with ten new ones built annually over the last decade. Developers build up when land and other costs (i.e., financing, construction, labor) rise and require bulking vertically.

📰 Senator Robert Menendez Accused of Corruption Involving Egypt

Egypt has received a staggering $1.3 billion annually from the American taxpayer since the late 1970s in exchange for it not shedding blood in Israel. When the gravy train of cash to Egypt was cut slightly in 2017 over human rights abuses, Senator Menendez was enlisted. According to unsealed indictments, Menendez and his wife received hundreds of thousands of dollars in cash, checks and bars of gold. Have any of you service providers ever received cash or gold bars as payment for services rendered?

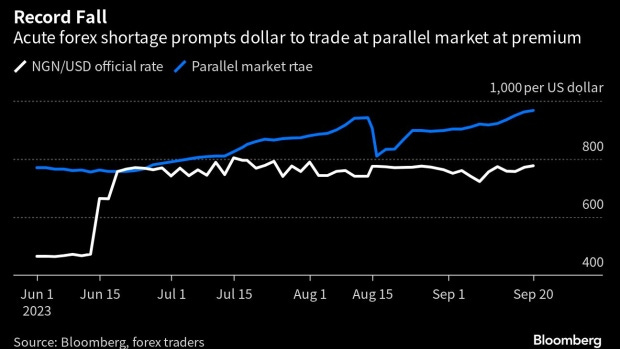

📰 Naira Plunges Toward 1,000 to the USD on the Street

The street price is a reflection of the market value of the Naira and is 29% weaker than the official exchange rate of 770 per one dollar. The divergence of the two rates is mainly due to a shortage of dollars in the country making people willing to give more Naira to secure scarce dollars.

📰 Burj Zanzibar to Become Tallest Timber Building in the World

The 315-feet high (i.e., 96-meter) Burj Zanzibar will be the largest building built primarily of wood in the world. Elements of the foundation will utilize concrete, the rest of the structure largely timber. Swedish EcoDataCenters built the world’s first wooden datacenter in 2018, and English football club Forest Green Rovers broke ground on a new wooden stadium earlier this year. Presently, steel and concrete construction is slightly less expensive in Africa, but timber construction wins out on speed.

📰 South Africa’s Largest Property Company Dives into Student Housing

Growthpoint will invest ZAR 1.2 billion (i.e., $64 million) in student housing by 2026. According to the IFC there is a shortage of 500,000 student housing beds. Critics say this sector looks attractive only because every other property sector in the ANC-dominated South Africa is underwater. It’s not certain that students will pay the rents that the financial models require to make the projects feasible.

📰 Vietnam Received $11.4 Billion from American Investors in 2022

In 2022, American businesses invested in 1,216 projects in Vietnam with total investment capital of $11.4 billion. America is the 11th largest foreign investor, and 2nd largest trading partner, in Vietnam. Bilateral trade hit a record of over $123 billion in 2022, up 11% from the previous year. Notably, Warburg Pincus made a $250 million investment into a real estate developer in Vietnam (i.e., Novaland) bringing the total invested in the country to $1.5 billion. For Warburg, Vietnam is its third largest Asian investment destination behind China and India.

📰 Philippine Coast Guard Removes Chinese Barrier in South China Sea

The special operation could only be ordered given the support provided by America’s Navy. Shockingly, shortly after announcing BRICS expansion the CCP released a new map of China claiming for itself lands and waters considered by all to be international waters or lands owned by other nations.

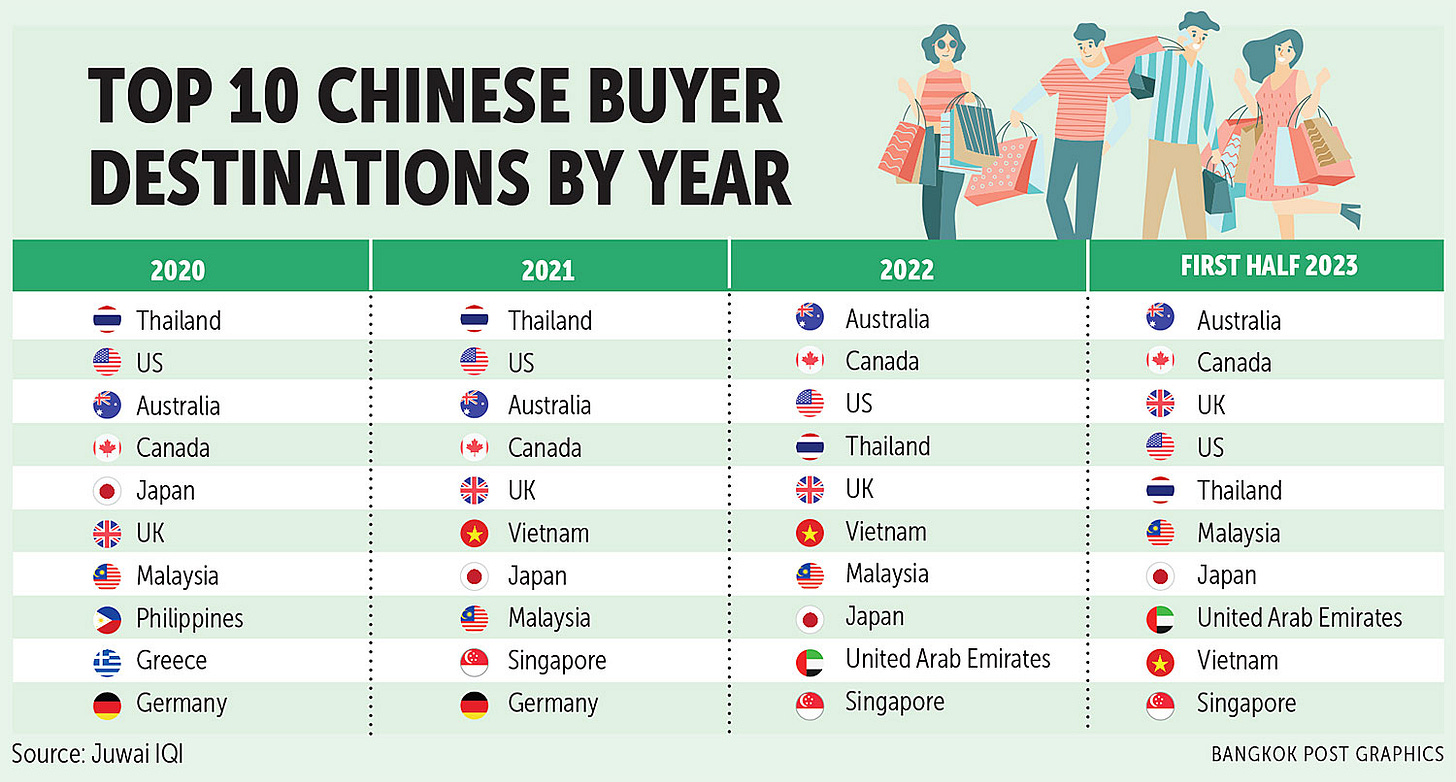

📰 Chinese Real Estate Buyers Buying Less in Southeast Asia

The reduction in Chinese real estate buyers in Southeast Asia is attributed to fewer Chinese tourists, and the impact of the country's economic decline on smaller-budget real estate purchasers. Taiwanese buyers have overtaken Chinese real estate buyers in Thailand as the #1 foreign buyers.

📰 Southeast Asia Might Be Ready For Datacenter Bonanza

America has 10GW of Datacenter capacity, exceeding the total capacity of the Asia Pacific region, yet the population in the later is 10x greater than that of America. In Asia, Beijing has the most capacity (2,773 MW) followed by Tokyo (2,674 MW). Singapore leads in Southeast Asia and is set to become the next 1GW-plus market in 2024. Indonesia, Malaysia, the Philippines and Thailand are on track to double capacity over the next five to seven years. The largest datacenter operators in the region are Equinix (44 sites) and NTT (36 sites).