Weekly Roundup | 8.29.2023

Top headlines and news impacting Latin America and Africa commercial real estate.

📰 Bogota’s Titan Plaza Sells GLA to Chilean Investor for $34 Million

Like most malls in Colombia, the Titan Plaza is owned through a horizontal management framework, resulting in many owners. The Titan Plaza is a 69,000 m² (743k ft²) GLA property comprising mostly retail with some office. Parque Arauco, the Chilean investor, purchased 51% of a trust owning 19,000 m² (205k ft²) of GLA. It has an option to purchase the remaining 49% over 24 months, and conversations with insiders indicate a cap rate of ~8.5% applied. Parque Arauco owns 1.1 million m² (12 million ft²) of total GLA in Chile (1982), Peru (2005) and Colombia (2008).

📰 There are Indicators that the Business Climate in LATAM is Improving

The business climate in Latin America rose in this third quarter of 2023 to its best level in the last two years and the second best in almost six years, according to the indicator released by the Brazilian center for economic studies Getúlio Vargas Foundation (FGV). Uruguay was the only country in the region to register a slight drop. Argentina, predictably, brings up the rear.

📰 Is BRICS Expansion a “Nothingburger”?

Argentina was admitted leaving experts to believe Argentina is looking for a new teat to latch on to as the IMF is beginning to demand a return of previous loans and structural changes to the left-wing government’s economy. In 2018, Argentina became the largest debtor in IMF history after accepting a $45 billion “loan”. Recently it took an additional $7.5 billion. Good luck China.

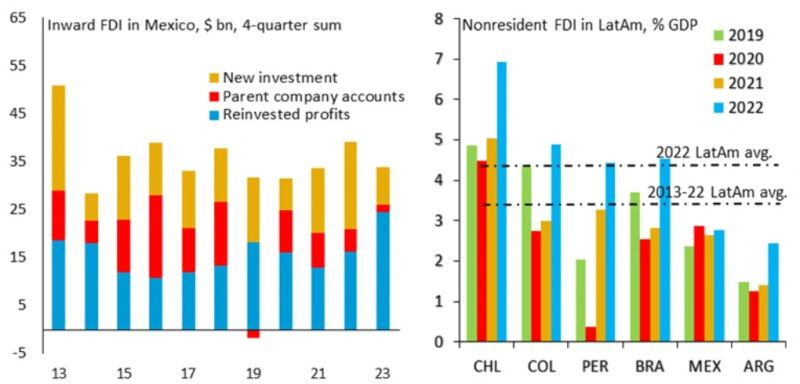

📰 FDI Inflows to Mexico Suggest Nearshoring Not Going As Thought

FDI inflows aren’t matching the hype pushed by the finance media regarding Mexico’s participation in America’s reshoring push. FDI flows are holding steady. Experts blame lack of action by the federal government to build technical colleges, deliver needed power generation, and address outdate regulations including onerous labor laws and unfair tax rules.

📰 John Hopkins Professor Suggests Colombia’s Inflation is 51%

Colombia reports 11.8%, and Professor Steve Hanke finds a rate more than 4x higher. He states, “the Banco de la Republica is producing fantasy numbers.”

📰 Mental Light Weight Floyd Mayweather Advocates South Africa Land Reform

The boxer worth over $450 million, instead of putting his money where his mouth is, urged land redistribution in South Africa. Foreigners have difficulty understanding nuanced South African politics, and it’s easy to get caught up in the hoopla and make a fool of yourself as Mayweather demonstrates with aplomb. The best Twitter/X comments are from the (black African) Zimbos.

📰 IFC Provides $236 Million for “Green” Real Estate in South Africa

The IFC is pushing further adoption of its EDGE certification program with a $236 million allocation to Absa bank to lend to “green” real estate projects in South Africa.

📰 Fortress to List Senior Unsecured Floating Rate Notes on the JSE

The securities include ZAR 300 million of notes due August 29, 2024, with a coupon of three-month Johannesburg interbank rate plus 125 basis points. Another tranche will be listed of ZAR 500 million notes due August 29, 2026 with a premium of 157 basis points. A third tranche of ZAR 600 million due on August 29, 2028 with a premium of 180 bps will also be listed.

📰 Kenya Permits Sectional Title Deeds

Since 2020, individuals may own title deeds of individual apartments. In Latin America, the primary method of funding multifamily is through presales to individuals used to secure a 4 - 5 year bank loan to construct the building. Once the units are sold to the owners, the bank’s capital is returned and investors’ returns realized. The building is managed by a trust which creates issues in some cases. Sub-Saharan Africa’s issue is lack of mortgage systems to make presales credible. LATAM has reasonably solid mortgage systems.