Weekly Roundup | 12.26.2023

Top headlines and news impacting Latin America, Africa and Southeast Asia commercial real estate.

📰 Colombia Cuts Interest Rate .25% to 13% Marking First Cut of Cycle

The small cut is a bit of a surprise given Colmobia’s stubbornly high inflation of 10.15%, far from the bank’s target of 3%. Professor Steve Hanke believes inflation in Colombia is 3x to 4x higher than what is stated. Brazil and Chile have each cut recently, but their inflation rates are under 5%. The Colombian peso is up 20% this year against the dollar, and many are predicting a rough 2024.

📰 Border so Bad Even Arizona’s Far-Left Governor is Concerned

Arizona’s Governor has called the National Guard to the border, a surprise move for the left-wing governor who usually labels all border measures as racist. The border chaos puts nearshoring gains at risk with legitimate trade and border crossings contending with the sea of illegal or fraudulent crossings.

📰 Is Canada’s Scotiabank Leaving Colombia?

The bank’s CEO said “maybe,” but the head of international banking, Fransisco Aristegueita, said “no”. Scotiabank operates in Colombia through a partnership with Colpatria Group, and the venture has steep losses so far in 2023. The bank recently announced it will allocate less capital to Latin America, and more to North America to shore up its beleaguered share price. Most Canadian banks placed bets in North America over the years, but Scotiabank looked further south into Mexico, Colombia, Peru and Chile for profits.

📰 Prudential Capital Group Mexico (“PGIM”) Secures $75 Million for Mexico

PGIM established a Mexico City office in 2018 but has operated in Mexico for more than 40 years. Prudential Financial is the parent and a $1 trillion global investment management and insurance business. The $75 million consists of two separate loans which will be used to expand PGIM’s property portfolio. Enrique Lavin is the head of Latin America for Prudential.

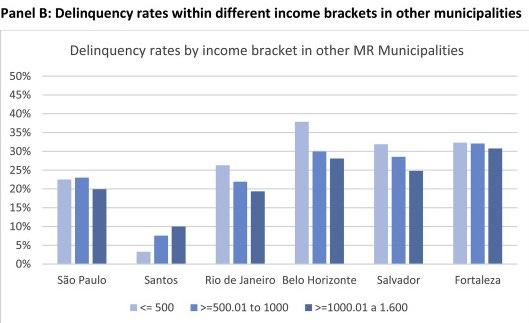

📰 Affordable Housing Could Surge in Brazil Next Year

Affordable housing sales should be buoyed by revisions to the Minha Casa Minha Vida (MCMV) social welfare program which provides subsidies and guarantees to low-income purchasers. Revisions lowered the qualifying thresholds, raised price limits, and reduced interest rates. Subsidizing home purchases helps developers, sellers of units, and politicians looking to reward voters. The MCMV program has an abysmal 28% delinquency rate which is likely to grow since standards have been lowered and benefits raised.

📰 Angola’s OPEC Exit Could Benefit China

OPEC output cuts constrained the ability of Angola to pump more to energy-hungry China. Leaving OPEC means more energy investments might be forthcoming since it can now sell as much oil as it wishes. In 2006, Angola was briefly China’s largest oil supplier so the two go back. Angola owes China just under $21 billion, according to World Bank data.

📰 Significance of Egypt’s Suez Canal to Emerging Markets

The winners (if Suez closes indefinitely) are large shippers whose shares are already surging, South Africa’s Cape Town which becomes a relevant sea hub once more, and nations attempting to decouple from China since shipping costs and complexity go up. The losers are Egypt which is a largely irrelevant country without the Suez Canal, Russian oil and gas shipments to China and India would be more costly, European exporters of agriculture and raw materials to Asia, and Asian importers to Europe of finished goods. This is an Emerging Real Estate Digest piece.

📰 South African Miner Raises $16.6 Million for Zambia Copper Recovery

The capital came from a private placement and will be used to mine a copper waste rock dump in Zambia. Jubilee Metals is partnering with UAE’s Resources Holding (“IRH”) with a goal of extracting 2,000 tonnes per month from the deposit. The deposit could hold up to 350 million tonnes of material, with a copper grade higher than 1.5%, and is the byproduct of over 60 years of mining in the area.

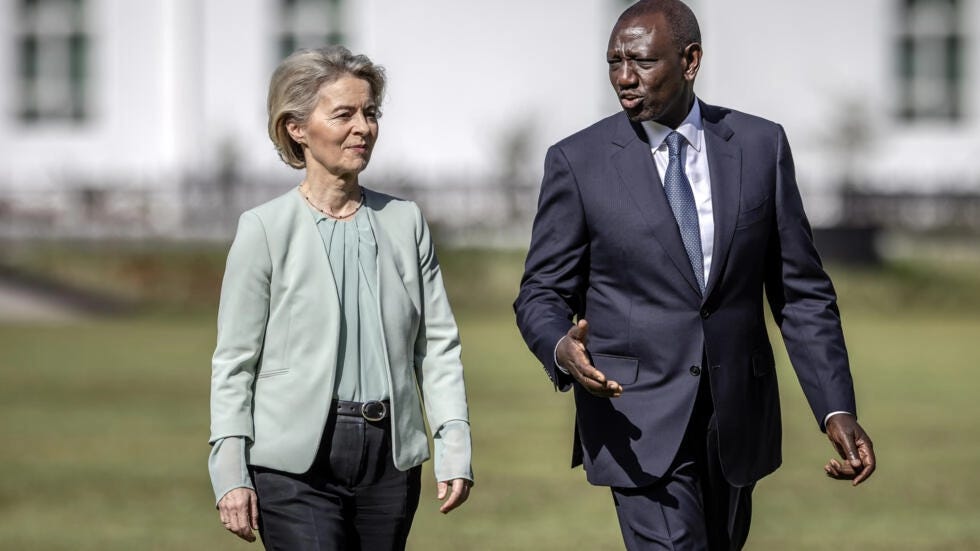

📰 Kenya and EU Sign One-Sided Trade Deal

The trade deal is the first between the EU and an African nation since 2016. Kenya is Africa’s 9th largest economy and is a major exporter of tea, coffee, flowers, fruits and vegetables to the Europeans. The trade accounts for 21% of Kenya’s exports making the EU its #1 export market. Kenya imports mainly from China with India being second, and the EU only third. Kenya gains from the agreement by being able to push more products duty-free into the EU. The EU only gains a promise by Kenya to reduce some tariffs on EU goods over time. The EU continues to show weakness and a lack of competence in engaging with African leaders.

📰 Chevron and ExxonMobil Snub Nigeria in Respective 2024 Spending Plans

Nigeria was ignored but capital was allocated to Libya, Ivory Coast, Kazakhstan, Guyana, Brazil and Singapore. Both are cash-rich at the moment and Exxon plans to spend between $22 billion and $27 billion annually through 2027. Half of this spending is to go to Kazakhstan’s Tengizchevroil project. It also recently agreed to buy Guyana’s discovery for $53 billion. Shell announced plans to pull back from Nigeria in 2021 but has been thwarted by legal challenges.

📰 Thailand’s “Bad” Economy Must Grow to get Investment says PM

Not satisfied with third-quarter GDP growth, Thai Prime Minister Srettha Thavisin still believes he’ll reach 5% average growth each year under his term. He blames the poor GDP growth this year on a sputtering tourism recovery and weak exports.

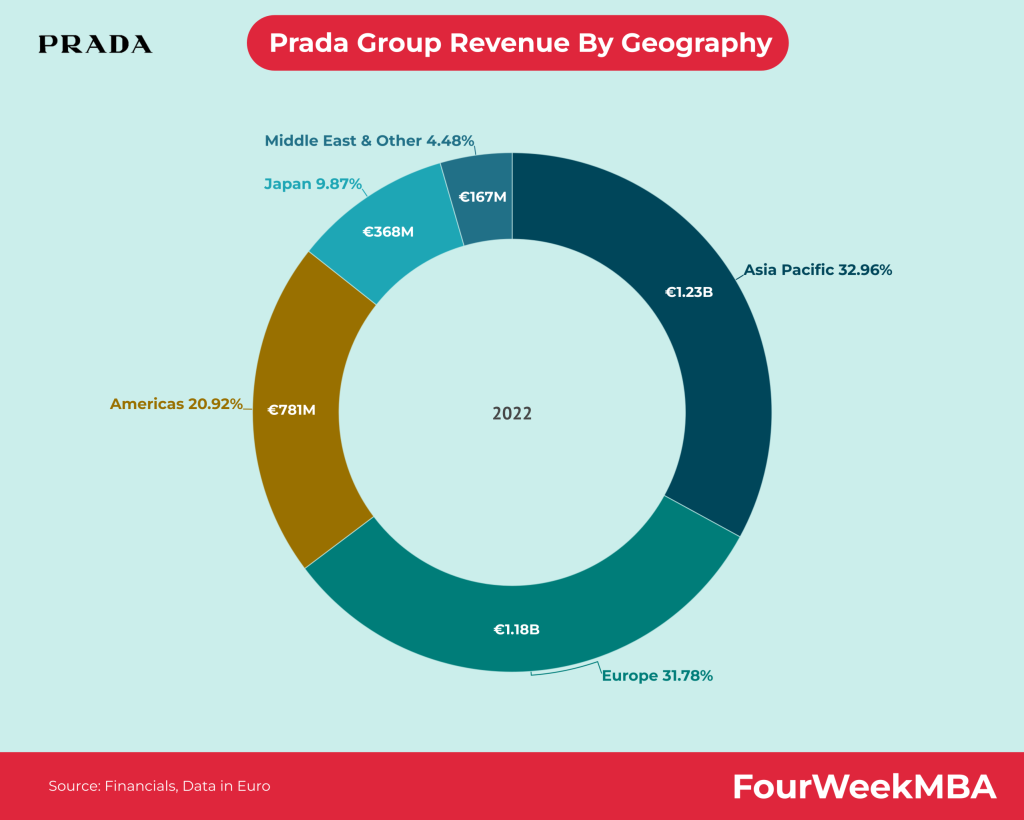

📰 Prada Expanding in the Philippines

The luxury Italian brand is expanding in the Philippines through a JV with the Tantoco family’s SSI Group as the local partner (40%). Prada already trades in the Philippines and the new JV will begin operations on January 1, 2024. Prada has recently announced its intention to double its business in China through opening more and bigger stores with more merchandise. A prada-themed coffee shop does well in China targeting big spenders.

📰 UK’s Actis Exits First Industrial Investment in Vietnam

The sale was to the local JV partner of the 49 percent stake in the 180-hectare (i.e., 445-acre) An Phat 1 Industrial Park in the north of Vietnam. The maiden real estate investment in the country occurred in June 2021 and amounted to around $20 million. Acits claims it “outperformed in both returns and exit time frame” on this one. Actis closed its second real estate fund, with $700 million of AUM, in 2022. These funds are now mostly deployed.