Weekly Roundup | 12.12.2023

Top headlines and news impacting Latin America, Africa and Southeast Asia commercial real estate.

📰 JPMorgan Chase Believes Mexico, Saudi and India Could Shine In 2024

The bank predicts a “bumpy” 2024 for developing market stocks, which would mark the sixth straight year when emerging market equities underperformed the S&P 500 benchmark. Egypt and Pakistan have benefited in 2023 from dollar inflows. Argentina and Poland from market-friendly elections, and China and Hong Kong have missed the end-of-year EM rally.

📰 Javier Milei Inaugurated Chief Executive of Argentina

The moderate candidate had a surprising win against the far-left and radical Peronist candidate, Massa, and on Sunday was sworn in as the troubled nation’s new President. He signaled austerity was coming by reminding in his speech that there simply was no money to fund programs and that reducing spending would help reign in inflation. Brazil’s Lula decided not to attend the inauguration, but Bolsonaro was there representing Brazil.

📰 Claire’s Expands into Mexico with Flagship Opening

The accessories global giant will enter Mexico through a partnership with Exalta. The 1,227 ft² (i.e., 114 m²) store is in the Plaza Satelite in Mexico City. Claire’s is based in Illinois and has 2,300 stores globally in 17 countries. It claims to have pierced 100 million ears over the years, more than any other retailer.

📰 Credit Suisse Sells REIT Business in Brazil to Patria for $130 Million

The Credit Suisse real estate platform ranks top 5 in Brazil. Patria has made a push to grow its Latin America real estate platform and has a strong presence in Colombia (JV with Bancolombia) and Chile, in addition to its home market. Its real estate NAV is valued at around $3 billion. Credit Suisse’s troubled real estate funds were put on the block by new parent UBS following its much-publicized insolvency early in 2023.

📰 Maduro Orders Immediate Exploitation of Guyana’s Oil, Gas and Mines

Venezuela’s far-left government is taking action to exploit minerals and energy resources in Guyana it believes it owns. The territorial dispute is over 100 years old, and Guyana’s rapid economic growth from oil and gas harvesting made it the fastest growing economy in the world last year. Venezuela's economy will grow by around 25% if it can commandeer the resources. The world is getting a free education on the uselessness of international bodies such as the UN and ICC.

📰 Milei Backs Trade Deal with Europe

The previous Peronist government did not support the EU-Mercosur deal, but Milei is all ears. Brazil and Spain support the deal as the de facto lead negotiators representing the sides. Paraguay is also leaning against the deal due to heavy-handed environmental regulations that prohibit developing countries from advancing. Annual trade between Latin America and Europe has grown 39% over the past decade to $414 billion.

📰 Gas Found in Zimbabwe by Australian Energy Group

Once the breadbasket of Africa, and one of the most successful countries on the Continent, Zimbabwe has languished for decades. Exxon recently abandoned a search for oil in the region. Invictus, the Australian group, said four samples from a well in the north showed the presence of gas. Cheap and reliable natural gas would go a long way to reliving Zimbabwe’s energy crisis. Under Mugabe, and now Mnangagwa, Zimbabwe became a place where dreams go to die, politicians become fabulously wealthy, with few things working properly.

📰 Six African Nations Receive Tariff-Free Access From China

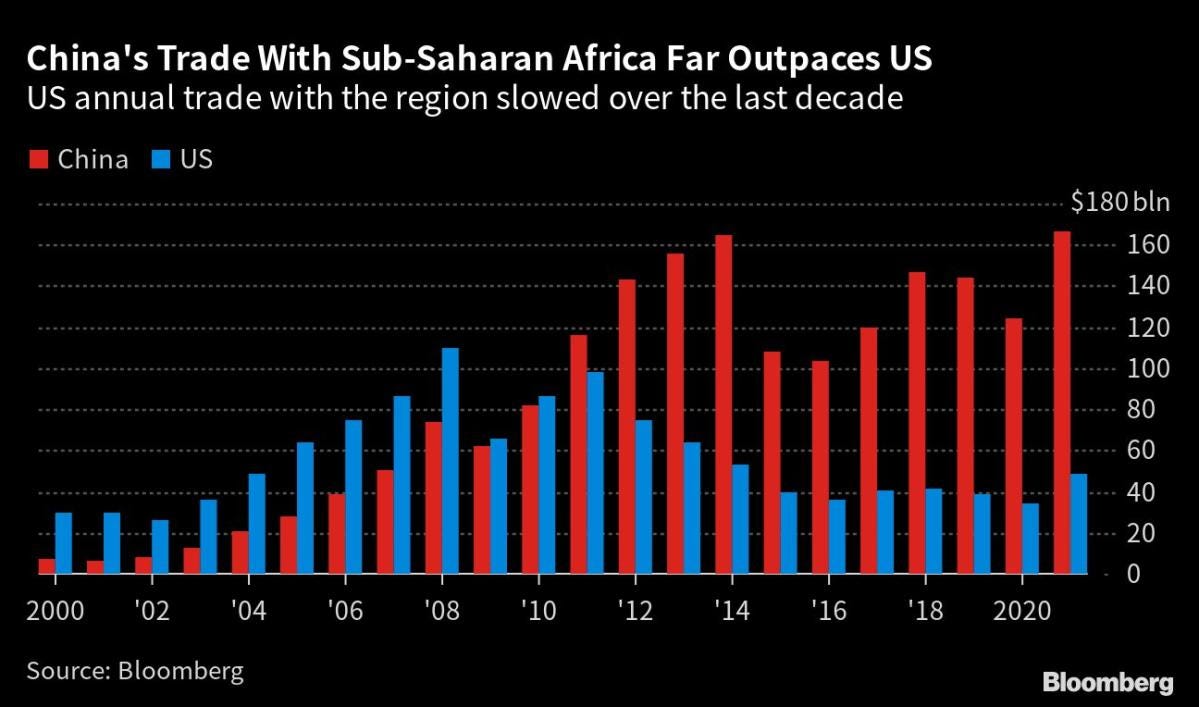

The nations are Angola, Gambia, DRC, Madagascar, Mali and Mauritania and they will not pay duties on 98% of previously taxable exports to China. China aims to import more Agriculture as it’s currently primarily buying raw material inputs from developing countries. Washington DC led efforts in Africa have mostly failed, resulting in billions being wasted, with no benefits accrued to America and very little to Africans. China has at least delivered results.

📰 FQM is Setback in Panama but Ramping Activities in Zambia

First Quantum Minerals is set to develop a copper deposit in Zambia’s central province, near the DRC border. FQM has halted operations at a major copper mine in Panama which recently closed due to protests followed by government interventions. Zambia has gone the other way making its business climate more favorable to encourage investments. FQM was founded in Zambia and now has mining operations around the globe and known for its expertise in copper extraction.

📰 The DRC is Africa’s Saudi Arabia

The DRC contains 50% of the world’s cobalt reserves and is responsible for 70% of global production. No other country comes close to the Congo in terms of reserves or production potential. Cobalt is generally joined in trace amounts with other metals, usually nickel and copper, and results as a by-product of processing those other minerals. Not so in the Congo where highly concentrated cobalt is uniquely found in sufficient scale making focused extraction economically feasible.

📰 Japan’s Largest Furniture Retailer to Open Store in Vietnam

Nitori Holdings, Japan’s largest furniture chain and with a similar offering to IKEA, will launch its first store in Vietnam next year. It has had a manufacturing presence in Vietnam since 2003 in Hanoi where it makes boxed furniture such as cupboards and bed frames. In 2015, it opened a plant outside Saigon to produce tables, chairs, and curtains. The IKEA clone has also recently launched in Thailand. Japan has the world’s oldest population (48.4) and must find consumers outside its borders to survive as a nation.

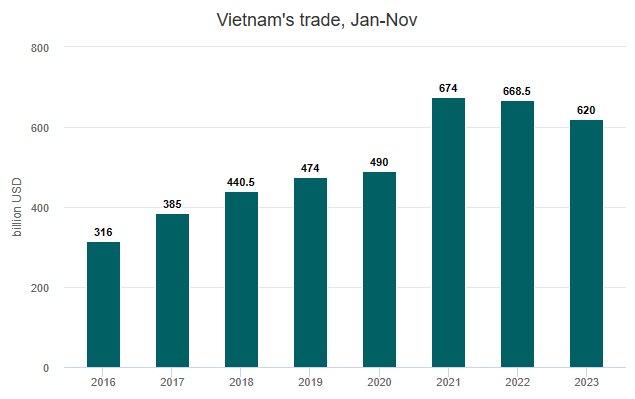

📰 Trade in Vietnam at a 3-Year Low Falling 8% to $620 Billion

Factories are scaling down operations due to an ongoing shortage of orders. America remains Vietnam’s largest export market at $88 billion, but that is down 13% from last year. China is second at $56 billion. Vietnam imports relatively little from America, with China, South Korea, and ASEAN being its largest import markets.

📰 Southeast Asia Received a Record $222 Billion in FDI in 2022

Southeast Asia has a large market (600 million people) and relatively good political stability, luring Chinese and American businesses. More and more manufacturing is relocating to Southeast Asia and American and Chinese companies are buying up businesses at increasing volumes. America is the leading investor in capital projects in Southeast Asia at $74.3 billion between 2018 and 2022, followed by China with $68.5 billion over the same period.

📰 Manila Luxury Residences Fastest Growing in the World

According to Knight Frank, Manila’s prime residences grew in value by 21.2% over the past 12 months. The rate surpassed Dubai (15.9%), Shanghai (10.4%), Mumbai (6.5%), Madrid (5.5%), Stockholm (4,7%) and other hubs which also experienced impressive sectoral growth.

📰 Japanese Property Investors Eyeing The Philippines

Japan is geographically close to the Philippines, and the nations and people have a good and cooperative relationship. Japan has plenty of capital, but horrible demographics with the world’s oldest average age of 48.4. The Philippines, in contrast, has one of the youngest at 25 years but lacks in capital. A match made in heaven? Japan will need to invest in young countries if it hopes to support itself shortly.