Weekly Roundup | 04.30.2024

Our pick of headlines this week impacting commercial real estate in the emerging markets.

Welcome to the Emerging Real Estate Digest, a newsletter and news media platform for investors and developers of real estate in the emerging markets. Sign up here.

🤝🏻 Our gentlemen's agreement is that we give you curated information for free, in exchange for you engaging with us on social media, and opening and sharing our emails.

✍️ Writer’s Guidelines for submissions.

Headlines:

Macy’s Warns Workers They May Be Fired If They Don’t Return to the Office

China’s Steel Overcapacity Foments Dumping Concerns

Main Reason Why Rates Will Get Cut Regardless of Where Inflation Will Stand

You Know LVMH For Its Luxury Bags. It’s Also a Titan of Real Estate.

Milei’s Team Sees Argentina Inflation Slowing Faster Than Economist Survey

Colombia’s Petro Gets Victory as Senate Approves Pension Reform

Do New Tariffs Mean Mexico is Bending to US Pressure on China?

General Motors to Shut Manufacturing Operations in Colombia, Ecuador

Sakeliga Warns of Coming Prohibition Against Minority-Owned Property Companies

De Beers Group to Relocate Auctions HQ From Singapore to Botswana

Shoprite Becomes Majority Shareholder in Delta, Asaba, and Owerri Malls

Vietnam Set to Launch New Stocks Trading System in Bid for Market Upgrade

Asean Overtakes China for Manufacturing FDI

Chinese Firms are Expanding in South-East Asia

Global

📰 Macy’s Warns Workers They May Be Fired If They Don’t Return to the Office

On Monday, the mall-based retailer informed its hybrid employees via email that the new policy will go into effect May 13, according to people familiar with the matter. The new policy will affect one-third of Macy’s corporate workforce, including the merchandising, marketing, and customer and digital teams, confirmed spokesman Chris Grams.

Read More: Bloomberg

📰 China’s Steel Overcapacity Foments Dumping Concerns

President Joe Biden asked US trade officials earlier this month to treble certain tariffs on imported Chinese steel and aluminum products to 22.5% from an average of 7.5%. Steel exports from China rose year-on-year by 36.2% to 90.3 million tonnes in 2023, while average export prices fell by 32.7% to $936.80 per tonne, according to official statistics.

“China’s overcapacity and non-market investments in the steel and aluminum industries mean high-quality US products have to compete with artificially low-priced alternatives produced with higher carbon emissions,” read a statement from The White House on April 17.

Read More: FDI Intelligence

📰 You Know LVMH For Its Luxury Bags. It’s Also a Titan of Real Estate.

LVMH, the owner of Louis Vuitton and Dior, has poured billions into properties around the world. “All roads lead to real estate,” said Michael Burke, who is head of LVMH Fashion Group.

LVMH uses its own money to fund smaller real-estate developments like individual buildings. For bigger undertakings like the Design District, it also invests via L Catterton, a private equity firm in which LVMH owns a 40% stake together with the family office of the company’s chief executive, Bernard Arnault, the world’s richest person.

Read More: The Wall Street Journal

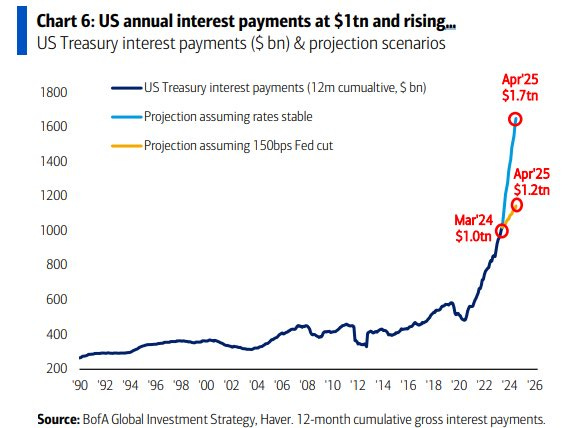

📰 Main Reason Why Rates Will Get Cut Regardless of Where Inflation Will Stand

The US government can’t afford interest payments at these rates.

Read More: X (Michal A. Arouet)

Latin America

📰 Milei’s Team Sees Argentina Inflation Slowing Faster Than Economist Survey

Milei’s economic team projects Argentina’s economy will contract 2.8% this year, less than the 3.5% drop seen by more than three dozen analysts polled by the monetary authority. Capital spending by the government declined 85% in the first quarter from a year ago when adjusted for inflation. Inflation (monthly) is projected to slow to 3.8% by September, much lower than the 6.2% monthly rate predicted by Argentina’s central bank in March.

Read More: Bloomberg

📰 Colombia’s Petro Gets Victory as Senate Approves Pension Reform

Lawmakers in the upper chamber voted to make the government the manager of around 70% of all worker contributions, while private pension funds would receive the rest. According to the bill, a portion of worker salaries, as much as 2.3 times the minimum wage, would go into the public system, while the balance goes into the private system. Private pension funds currently receive 75% of the volume of worker contributions, Corredores Davivienda estimated. Colombia’s private pension funds have been major investors in real estate funds and projects and they are emptying.

Read More: Bloomberg

📰 Do New Tariffs Mean Mexico is Bending to US Pressure on China?

The federal government has implemented new tariffs on hundreds of imports from countries with which it doesn’t have trade agreements, a move that appears mainly directed at China. In a decree published on Monday, the government said that 5-50% tariffs would apply to 544 products across a range of categories including steel, aluminum, textiles, wood, footwear, plastics, chemicals, paper and cardboard, ceramics, glass, electrical material, transport material, musical instruments and furniture.

Read More: Mexico News Daily

📰 General Motors to Shut Manufacturing Operations in Colombia, Ecuador

The plant's closure comes amid a 14-year low of sales of new vehicles in 2023 versus 2022 in Colombia, according to a report released by two industry groups in January. Its Colombia manufacturing plant was operating at 9% capacity, General Motors said, while its Ecuadorean operation was at 13% capacity. GM will maintain dealerships in both countries.

Read More: Reuters

Africa

📰 Sakeliga Warns of Coming Prohibition Against Minority-Owned Property Companies

On 13 March 2024, the Property Practitioners Regulatory Authority (PPRA) announced that BEE is now a precondition for doing business in South Africa. “Property practitioners” with less than 40 points on a BEE scorecard will be refused their Fidelity Fund certificate, making it illegal for them to continue operations. Racial minorities will now be forbidden from benefitting from any property transaction without handing shares to a black partner.

Read More: The Cape Independent

📰 De Beers Group to Relocate Auctions HQ From Singapore to Botswana

This move mirrors one in 2015 when a high-end sales division relocated to Gaborone, Botswana’s capital city, from London in 2013. Bringing the two functions to the same city will enhance efficiency, strengthen partnerships, and support the development of diamond-industry skills in Botswana. Anglo America, the parent of De Beers, has been in talks with Botswana’s government which culminated in the signing of a heads of terms in October 2023. De Beers has been losing market share and posting lower profits and revenues.

Read More: De Beers Group

📰 Shoprite Becomes Majority Shareholder in Delta, Asaba, and Owerri Malls

In their 2023 annual financial statement, Resilient REIT disclosed the disposal of their stake in Resilient Africa, the joint venture between Resilient REIT (60.94%) and Shoprite Holdings (39.04%) that owns Delta, Asaba, and Owerri Malls. This move makes Shoprite Holdings the sole owner of the malls, and further solidifies its presence in the Nigerian retail market, despite the sale of its supermarket network in Nigeria to Ketron Investments, a subsidiary of Persianas Investment in 2021.

Read More: Estate Intel

Southeast Asia

📰 Vietnam Set to Launch New Stocks Trading System in Bid for Market Upgrade

Vietnam will launch a new stock trading system next Thursday that is expected to include faster transaction settlement. Vietnam could become reclassified as an emerging market. Major indices including MSCI and FTSE currently consider Vietnam a frontier market. Becoming an emerging market could bring inflows of up to $25 billion—or 6% of the country’s GDP—by 2030, World Bank officials said.

Vietnamese officials said FTSE could announce that it will upgrade Vietnam to emerging status by September, Reuters reports, with the official change to come next year. Because of its frontier market classification, Vietnam is not eligible for investment by many funds.

Read More: Reuters

📰 Chinese Firms are Expanding in South-East Asia

One reason why Chinese firms are expanding abroad is political. President Joe Biden’s administration has added more controls to those introduced by Donald Trump on products made in China. Chinese firms sometimes bypass these restrictions by moving factories to countries in the region. One Chinese businessman who moved to Hanoi, Vietnam’s capital, nearly two decades ago estimates that 40% of factories in northern Vietnam are now Chinese-owned. Annual foreign direct investment from China to Indonesia, Malaysia and Vietnam hit $8bn in 2022, quadruple the amount a decade earlier. Indonesia is the most important market for Chinese firms.

Read More: The Economist

📰 Asean Overtakes China for Manufacturing FDI

The Asean region has recently overtaken China as the destination of choice for manufacturing investment for investors from OECD countries. More than $55bn was pledged by OECD-headquartered companies to build factories in Asean in 2022 and 2023, more than double the $21bn announced in China, according to fDi Markets. This is in stark contrast to 2018, when China attracted $56.8bn of manufacturing, more than twice the amount pledged to Asean.

Read More: FDI Intelligence