Weekly Roundup | 04.09.2024

Our pick of headlines this week impacting commercial real estate in the emerging markets.

Welcome to the Emerging Real Estate Digest, a newsletter and news media platform for investors and developers of real estate in the emerging markets. Sign up here.

🤝🏻 Our gentlemen's agreement is that we give you curated information for free, in exchange for you engaging with us on social media, and opening and sharing our emails.

✍️ Writer’s Guidelines for submissions.

Headlines:

TSMC Expands U.S. Investment to $65 Billion After Securing $6.6 Billion Grant

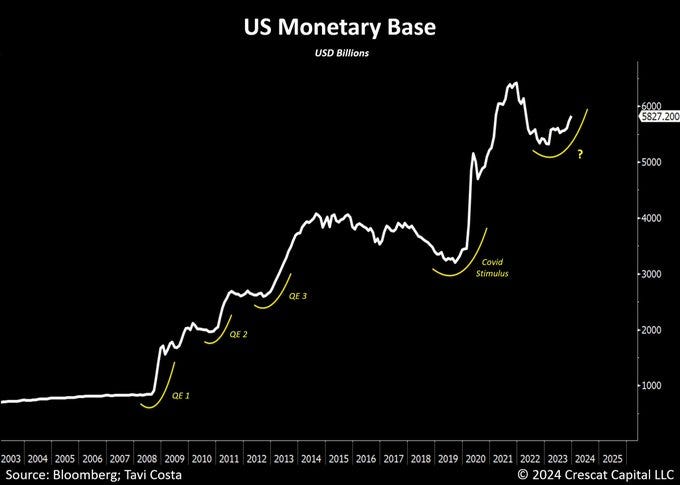

US Monetary Base Rising Despite High Interest Rates

KKR Says China’s Real Estate Correction May Only Be Halfway Done

Coppel to Invest Over $700 Million in 2024 to Expand Its Presence in the Mexican Retail Sector

Brazil Seeks Real Estate Market Boost as Lula Pushes for Growth

Brazil Bank Partners with Miami Developer to Launch a PE Real Estate Fund

A Mexican Drug Cartel’s New Target? Seniors and Their Timeshares

South Africans Still Value Shopping in Person Says Redefine

South Africa’s Ports Among the Worst in the World

Emira Sells ZAR 1.1 Billion Western Cape Portfolio to Spear Reit

SA Corporate Eyes Further Expansion Into Multifamily Residential Market

Philippines' DoubleDragon Subsidiary Hotel101 Global to List in US

Japan “Most Trusted” by ASEAN Despite Low Influence, Study Shows

Chinese Automaker to Build $800 Million Factory in Vietnam

Global

📰 TSMC Expands U.S. Investment to $65 Billion After Securing $6.6 Billion Grant

"Taiwan Semiconductor Manufacturing Co. has agreed to increase its U.S. investment by more than 60% to over $65 billion and produce the world's most advanced 2-nanometer chips on American soil.U.S. Commerce Secretary Gina Raimondo said TSMC will also build a previously unannounced third chip plant in Phoenix, Arizona, that will be operational by 2030.

"For the first time ever, we will be making, at scale, the most advanced semiconductor chips on the planet here in the United States of America," Raimondo told reporters the day before the official announcement on Monday, adding that these chips would "underpin all artificial intelligence [demand]." The investment will be the largest foreign direct investment in U.S. history for a greenfield project, she added.

TSMC will also receive $5 billion in loans and be able to claim an investment tax credit of up to 25% of capital expenditures. Raimondo said 14 suppliers are planning to construct or expand plants in Arizona or elsewhere in the U.S. to support the TSMC fabrication plants. She added that 70% of TSMC's customers are U.S. companies and have made it clear that they want to buy American-made chips."

📰 US Monetary Base Rising Despite High Interest Rates

This chart is strong evidence that interest rates should be increasing and that talk of cuts is perhaps a pipedream. Only media pundits and bureaucrats believe inflation is under control. The point of raising rates is to pull more money out of an economy overheating. This isn’t occurring at current rates.

📰 KKR Says China’s Real Estate Correction May Only Be Halfway Done

China’s real estate troubles are likely far from over and industry problems need to be addressed quickly for GDP growth to rise significantly, according to KKR. Based on comparisons to housing corrections in the U.S., Japan and Spain, China’s “housing market correction may be just halfway complete” in terms of its depth, the report said.

Latin America

📰 Coppel to Invest Over $700 Million in 2024 to Expand Its Presence in the Mexican Retail Sector

Coppel will invest heavily to expand its Mexican retail holdings by opening more than 100 new store locations and renovating 1,782 stores in 2024. Last year the dominant retailer in Mexico increased its retail GLA by 28%.

📰 Brazil Seeks Real Estate Market Boost as Lula Pushes for Growth

Lula is seeking top-down interventions to boost Brazil’s ailing economy by encouraging more real estate transactions. The plan includes a push to expand the securitization of housing loans, people familiar with the matter said. One of the options being mulled is subsidizing part of the cost of securitizing bundles of housing loans held by banks, which could then be sold to funds and free up lenders’ balance sheets so they could lend more. The measures, which seek to make the debt more attractive to banks and investors, are still being finalized and there are no details on how much the government could offer in financing.

📰 Brazil Bank Partners with Miami Developer to Launch a PE Real Estate Fund

The Inter Resia Opportunity Fund I has raised $30 million in capital to develop an affordable housing project in Miami. The Miami developer is Resia, and the Brazilian digital bank is Inter&Co.

📰 A Mexican Drug Cartel’s New Target? Seniors and Their Timeshares

One of Mexico’s most violent criminal groups, Jalisco New Generation, runs call centers that offer to buy retirees’ vacation properties. Then, it empties its victims’ bank accounts. The scheme has netted the cartel, Jalisco New Generation, hundreds of millions of dollars over the past decade.

Africa

📰 South Africans Still Value Shopping in Person Says Redefine

“South Africans still value in-person shopping, especially at one-stop centres that offer access to everything in one location. Due to the inflationary environment, consumers’ disposable income is still under pressure, which has led to a significant focus on essential pharmacy, supermarket, and value fashion retailers for spending,” says Nashil Chotoki, Redefine’s national retail asset manager.

📰 South Africa’s Ports Among the Worst in the World

The volume of rail and port cargo handled in South Africa has declined significantly over the past few years, with the country’s ports now ranking among the worst in the world. Reliable infrastructure and well-maintained equipment can boost productivity, while a lack of adequate infrastructure investment will weigh heavily on productivity. In the case of South Africa, capital investment declined every year from 2016 to 2020, while capital formation contributed just 0.5%, on average, of the country’s real GDP growth in 2021-2023.

📰 Emira Sells ZAR 1.1 Billion Western Cape Portfolio to Spear Reit

Emira Property Fund, which counts fellow JSE-listed Castleview Property Fund as its major shareholder, on Tuesday announced a R1.146 billion deal to sell “basically all its wholly owned Cape Town properties” to Spear Reit in somewhat of a surprise move. The portfolio comprises six office properties, five industrial facilities and two specialist/retail properties, with the majority of the portfolio value being in office properties. The selling price was only at a slight discount to book value according to Emira’s CEO.

📰 SA Corporate Eyes Further Expansion Into Multifamily Residential Market

Following the South African “mega” property investor’s ZAR 1 billion (i.e., $53 million) acquisition of Indluplace Properties last year, the investor is eying further expansion in the multifamily residential market. The REIT has largely divested out of office, barring some mixed-use properties with office space it continues to hold.

Southeast Asia

📰 Philippines' DoubleDragon Subsidiary Hotel101 Global to List in US

Philippine real estate firm DoubleDragon (DD.PS) on Monday said subsidiary Hotel101 Global will list on the Nasdaq in the United States via a merger with special purpose acquisition company JVSPAC Acquisition Corp (JVSA.O). Hotel101 Global will become the first Philippine company to list in the U.S. following the deal. The hotel group is partially owned by Jollibee Foods owner, Tony Tan Caktiong. Hotel101 is expected to have an equity value of over $2.3 billion.

📰 Japan “Most Trusted” by ASEAN Despite Low Influence, Study Shows

The study also found that Southeast Asians, for the first time, favor alignment with China over the United States. They cite poor and inconsistent policy actions from Washington DC and the benefits of Bejing’s Belt and Road Initiative. Japan is the most trusted yet has little influence in the region relative to China and the United States.

📰 Chinese Automaker to Build $800 Million Factory in Vietnam

Chinese automaker Chery's Omoda&Jaecoo and Vietnamese company Geleximco signed a joint venture agreement on April 4 in the northern province of Thai Binh to construct a US$800 million automobile plant. Construction on the factory will begin in the third quarter of this year with the initial phase set to be completed in the first quarter of 2026. After completing phase one, the factory will raise its capacity of producing about 50,000 vehicles per year.