Weekly Roundup | 01.16.2024

Top headlines and news impacting Latin America, Africa, and Southeast Asia commercial real estate.

📰 Brazil's Demographic Headwinds: Too Few Young People and Too Many Retirees

Latin America's demographic woes are caused by high rates of young people immigrating to wealthy countries seeking economic advantages, and a declining domestic birth rate. Brazil, a country with historically impressive birthrates and population growth trends is expected to “shrink” (based on estimates) by five million this year and growth rate trends are the lowest the country has seen since 1872.

📰 Fitch is Cautiously Optimistic About Latin American Real Estate in 2024

GDP growth is expected to be less than what was experienced in 2023 (2.8%), and considerably less than in 2022 (4.0%). Fitch expects the Mexico nearshoring-induced industrial boom to continue to gain steam, even though the American economy is at risk of slowing. Shopping malls did better than the pundits predicted in 2023 and Fitch believes this will continue due to strong cash flows and sound liquidity for most large mall owners. It doesn't believe most retail tenants it follows will have issues handling inflation-adjusted rents this year.

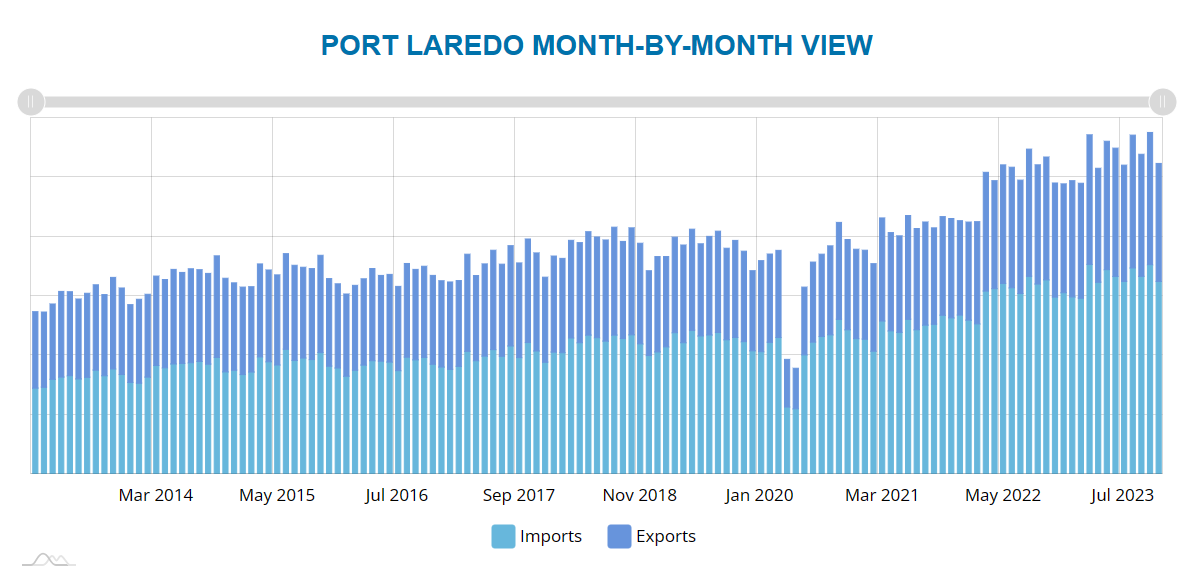

📰 Laredo Demonstrates How Border Towns Can Gain From Nearshoring

Much of the future investing targeting nearshoring, particularly from institutional real estate investors, will occur on the American side of the border. These investments will often be more suitable for American institutional investors and tap into much larger pools of capital than what is available for investments into Mexico.

📰 Markets Expect Similar Rate Cuts for Brazil and FED

Emerging Real Estate Digest has previously written that emerging markets are beholden to what the Fed does. Cutting too early risks currency collapse. The market is now predicting Brazil’s rate cuts in 2024 will amount to -175 bps, a figure almost the same as what is predicted for the Fed.

📰 Africa Miners Take Note of $182 Million Saudi Earmark for Exploration

The capital allocated is to discover and mine mineral resources in Saudi Arabia, but African miners should take note. Saudi is flush with cash and is making moves to expand its economy from mostly oil-driven to include minerals associated with the energy transition. It has made several statements recently indicating high interest in financial partnerships in Africa. As Saudi builds its home capacity and expertise it will be more likely to venture into Africa where much more mineral wealth sits.

📰 NBA Africa’s Dreams Turn Into Nightmares and Regrets

The NBA's foray into Africa has largely been a failure with investors losing most of the capital already invested. It entered Africa too aggressively and with too big of a splash. It has experienced success in China, Japan, the Philippines, Israel, UAE, Mexico, Argentina, and Europe. In these markets, it tested the waters and responded to market dynamics to build appropriate and sustainable businesses. There is something about Africa, for some investors, that makes them go all in. The NBA case study is a good one for investors considering a first investment in Africa.

📰 Foreign Airlines Lobby Nigeria to Release Trapped Dollars

Nigeria's currency issues seem to be neverending and only getting worse. Foreign airlines striking would have a devastating effect on an economy and capital market already on its knees. The lack of dollars is in part caused by plummeting FDI, but the FDI decreases are partially due to dollar shortages raising repatriation concerns. A Catch-22.

📰 South Africa’s FirstRand Seeks Growth in Africa Through Acquisitions

FirstRand is a major banking group in South Africa and its incoming CEO is keen to look outside of South Africa for growth. The domestic economy is on the retreat and plagued by mismanagement and power blackouts. South Africa has a world-class banking sector and strong capital markets, compared to the rest of Africa, and is well-suited to take a leadership role in developing Africa's capital markets and industries.

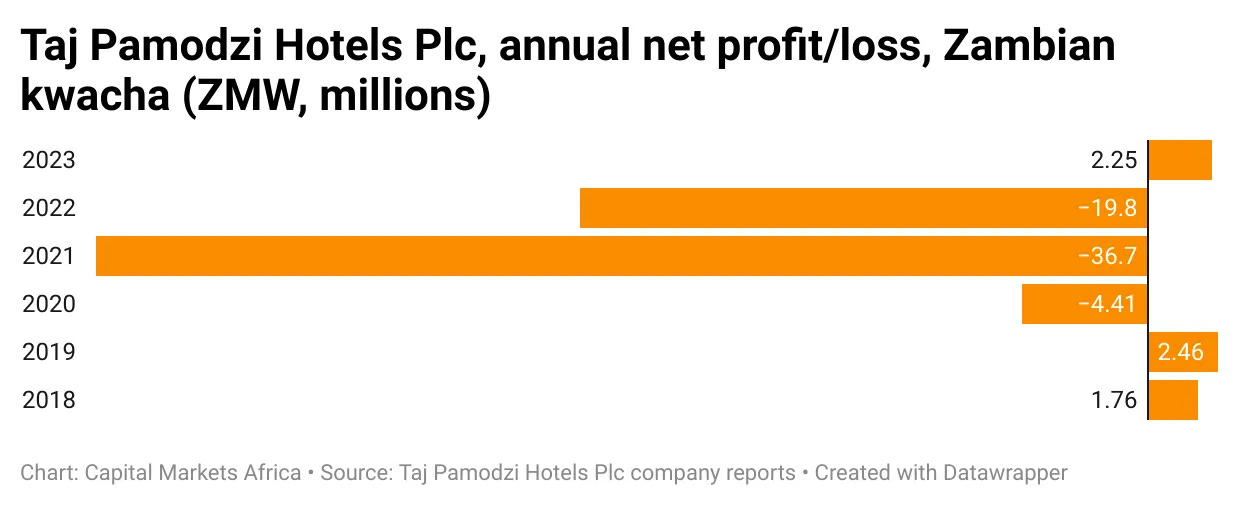

📰 Zambia’s Iconic Taj Pamodzi Hotel Sold to UAE Group for $18 Million

The deal highlights the growing importance of Gulf money to African markets. the Taj Pamodzi once dominated in Lusaka and has faced stiff competition from new entrants with arguably equal or better offerings. Perhaps being a public company hurt it and now it will be private which could help it compete better in the market. The 192-bed “five-star” hotel was in talks to be purchased by the Tata Group of India before ASB Hospitality (UAE group) purchased it.

📰 LEGO to Open Its $1.3 Billion Factory in Vietnam This Year

LEGO is investing heavily to expand its Mexico plant as well as its operations in Vietnam. What makes this one special is the proximity to customers in Asia, which is the fastest-growing region in the world for the $262.2 billion toy market. LEGO is the largest toy company in the world with over a 6 percent market share.

📰 Nestle Invests Further $100 Million in Vietnam to Expand Coffee Production

Nestlé has a strong presence in Vietnam to make products to sell to the Vietnamese consumer, but particularly with coffee, export is also the goal. Coffee consumption has soared 60% in Vietnam in just five years owing to increased purchasing power and continued adoption of a culture already coffee lovers. Vietnamese coffee beans are known for higher caffeine content and bolder flavor than beans from places such as Brazil and Kenya. This investment will ramp up the production capacity by an additional 20,000 tons of coffee beans annually, which translates into an additional 1 billion cups of coffee annually.

📰 Chinese Retailer Places $15 Million Bet on the Philippine Consumer

DALI is a Chinese (through a Swiss entity) hard-discount grocery retailer that has gained a 6% market share in the Philippines in a short period and is now moving beyond groceries and into rural areas with a $15 million investment from the Asian Development Bank, which itself is based in Manila. The success mirrors ALDI in America against entrenched competitors, and in Colombia the battle playing out between D1 and Ara against Exito. Competing head-to-head with incumbents on their terms is dangerous in emerging markets since a handful of families tend to control most major businesses as well as having an outsized influence on capital movements and politicians.