Part 3: Data Center Series

Mega hype around data centers, and lack of negative headlines, should give any wise investor pause. Let's consider the potential downsides to data center investments.

In this three-part series we will examine the data center investment thesis and its impact on emerging market real estate investors. The parts are:

👉 Cautionary Note (i.e., 🐻 Bear Case)

Emerging market economies counting on further foreign direct investments in the data center space should do so with caution. The investment thesis for data centers globally has come under pressure, with an increasing number of short investors circling and placing their bets. Perhaps the most influential of these short sellers is Jim Chanos who is certain that American data center REITs are in for a bumpy ride.

Interest Rates

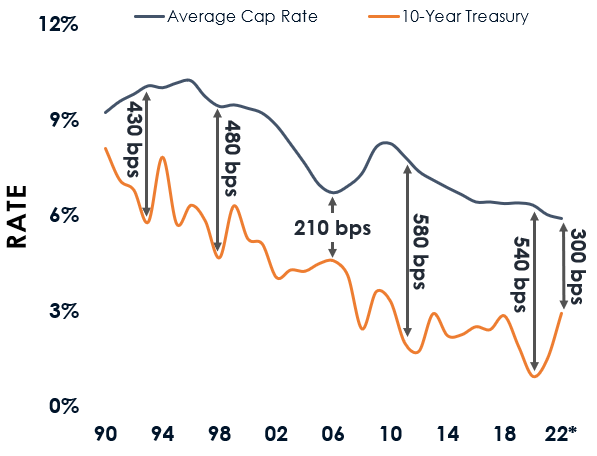

Like every class of real estate, dramatically higher interest rates are having adverse impacts on returns for holders of data centers. When interest rates go up, equity investors require higher returns to be persuaded to part with their money. Higher interest rates = higher cap rates.

Spiked interest rates have the additional negative effect of increasing the cost of debt for projects, which reduces the amount of future cash flows available for distribution to investors and to fund operations. A saving grace for data center investors is many raised capital when rates were lower, at fixed rates, and therefore are temporarily shielded.

Poor Valuations and Private Equity Market Maker

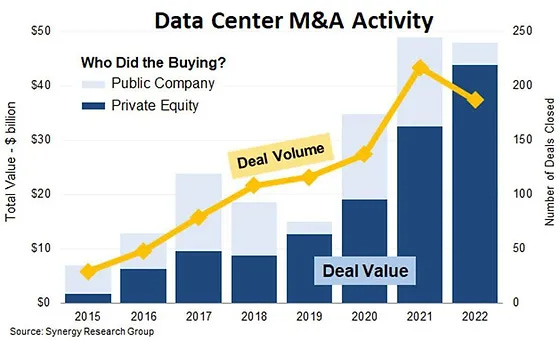

During the data center investment frenzy there was more capital available than there were suitable data center deals. As such, cap rates compressed and towards the end of the cycle most deals were being concluded at valuations based on cap rates of between 5% and 7%. Many data center transactions closed in 2021 at valuations of 20x-30x EBITDA. Data Bridge’s $11 billion purchase of Switch in 2022 was based on an astounding valuation of 40x EBITDA. Some of these buyer are already sellers, and reports are that off-market listings are being marketed at cap rates of 9% or higher.

Private equity activity in the space has slowed dramatically this year as the investors digest their purchases and come to terms with what they are actually holding. A warning sign for any asset class is when “dumb” money becomes the driving force of transactions within an investment theme. Since private equity is perhaps the dumbest of all money, the alarm bells should be ringing. From 2015 to 2018, 42% of data center deals involved private equity buyers. This share increased to 65% from 2019 to 2021, and to more than 90% in the first half of 2022.

Hyperscaler Competition

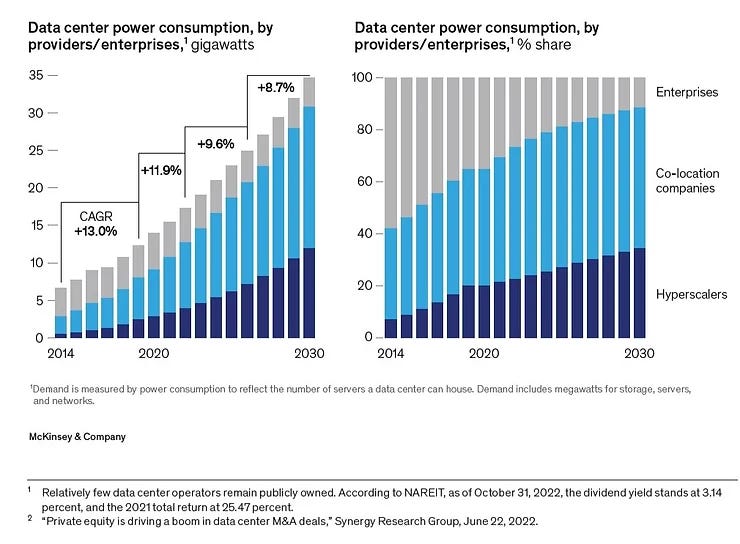

Valuations for data centers are additionally being driven down by more competition from the hyperscalers. For co-location data center owners, hyperscalers are a mixed blessing. On one hand hyperscalers are well-funded tenants with immense and growing data storage and processing needs. But hyperscalers are increasingly becoming competitors by building and owning their own data centers.

It’s never a good position for a landlord to have its biggest tenants also be competitors. This is the precise situation co-location data center land lords find themselves vis-à-vis their hyperscaler tenants. Even where hyperscalers remain in a co-location data center, the threat of building their own facilities provides leverage to negotiate better terms. These better terms usually mean shorter duration leases signed, and less net rent to the data center landlord.

Accounting Issues

Data centers, as a category of real estate, are perhaps the most capital intensive to maintain of them all. The cooling systems and servers are expensive and must be replaced every couple of years. To not do so is to risk costly downtime from server failure or overheating.

It is alleged that some of the private equity (and REIT) owners of data centers have categorized the expenses to replace the servers, cooling and other equipment as growth capital expenditures. By so doing, the major and predictably recurring expenses are excluded from NOI calculations resulting in arguably artificially higher NOI-based valuations. For this situation to continue, new data center developments, or the expansion of existing, are required. Skeptics point to this as one possible reason why the data center investment frenzy continued longer than seemed reasonable, and why the data center investments during the peak in 2022 were driven almost exclusively by private equity purchasers and sellers.

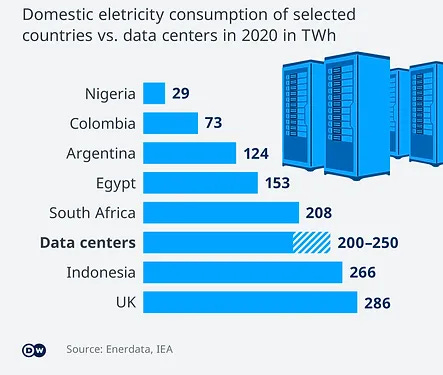

ESG Risk

An environmental public relations risk exists for owners of data centers given the amount of electricity and water they require to operate. One data center can use as much power as 80,000 households. The hyperscalers mask much of the electricity they consume through purchasing carbon offsets, but this PR strategy may not continue to be as effective in the future as it is now. Datacenters are rarely hooked into renewable energy grids due to the unreliable and inconsistent nature of these power sources. When the wind isn’t blowing or sun shining, the data center still requires steady power to avoid costly outages. Diesel generators are often the stop gap measure employed by those stuck on solar or wind grids.