In this three-part series the Emerging Real Estate Digest will examine the investment case for Argentina. The final edition of the series will be published just two days before the consequential election for Argentina’s new President to take place on October 22, 2023. The parts are:

👉🏻 What the Hell Went Wrong With Argentina?

Argentina was Born to be an Exporting Superpower

Replacing Brazil as the King of South America 🤴

What the hell went wrong with Argentina? The Constitution it promulgated in 1853 was a model for the world, and after decades of economic growth and institutional maturation, the country was a top 10 wealthiest country by 1913. Over a fifty-year period from 1880 the GDP grew at an average rate of 6%, GDP per capita at an annual rate of 3%, and the population ballooned from 3.43 million to 11.05 million inhabitants.

A military coup in 1930 broke the back of Argentina’s constitutional republic and took the country from one dedicated to rule of law and institutions, to one of rule for the special interest and by political elites. In 1946, Juan Peron and his wife Eva Peron (i.e., “Evita”), took the reigns of power and finished the job of fully wedging government between the workers and the economy, making it the sole arbiter and resolver of all things labor.

After nearly 100 years of devotion to Peronism, the Argentina of today is one characterized by corruption, underperformance, inflation, unpaid bills and another failing currency.

🙃 Four out of ten Argentinians live in poverty.

🙃 62% of the federal budget are welfare expenses.

🙃 Nine sovereign debt defaults have occurred.

🙃 The country in 2001 had five Presidents in two weeks.

🙃 It is the largest IMF debtor in history.

🙃 Plagued by constant stagflation which reached 5,000% in 1989.

🙃 Four currencies have imploded under Peronism with the fifth in crosshairs.

It’s time to start crying Argentina. 😭😭

Mass Migration Set the Stage

Societies often benefit from migration, but not always. There’s a good case to be made that Argentina was a bit unlucky with its mass migration from Europe which continued unabated until after the first world war.

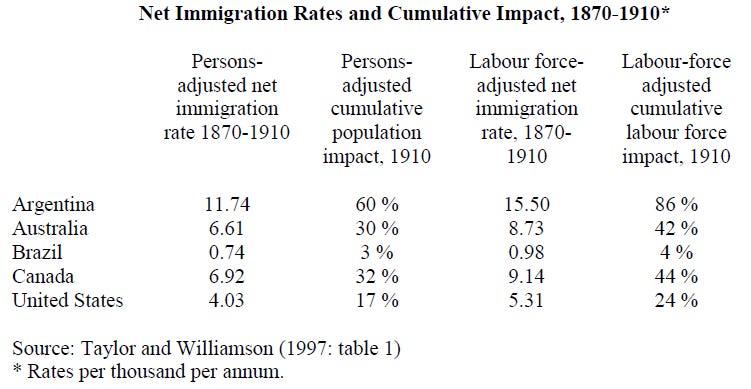

Argentina was unable to adequately assimilate quickly enough the proportionally vast sums of worker migrants it admitted. Immigration rates in Argentina in the 19th century far surpassed other migrant-hungry countries such as Australia, Canada and America. Around 70% of the immigrants came from Spain and Italy, and by 1910 Argentina had one of the highest rates of foreign population workers in the world.

Most of the early immigrants to Argentina were unskilled, illiterate and many infested with the anarchist communist ideology. Argentinian immigration statistics from 1914 indicate that 42% of the newly arrived immigrants that year were illiterate. Anarchist communism as an ideology had lost steam in Europe, and Argentina became a magnet for the adherents who were nudged or pushed out of Europe.

The 1930 military coup has been theorized to have been partially motivated by an attempt to prohibit the new arrivals, who were rapidly gaining voting rights and other powers, from wrestling control of the country away from the landowning gentry class. The coup savaged the old Constitution, which was modeled on America’s, and in its place was one established which centralized power (rejecting Federalism), expanded the executive branch, weakened checks and balances, suspended civil liberties, and empowered the government to intervene in the economy.

Argentina has been a political and economic mess ever since.

“Peronism Trap” in a Nutshell

Sixteen years after the military coup, in 1946, General Juan Peron became President and successfully forced in his leftist version of Benito Mussolini’s ideology into the body politic. Peron was an admirer of Fascism and Nazism from the beginning. He gave protection to hundreds of Nazi war criminals, and implemented policies to deny visas for European Jews fleeing extermination. His governing philosophy has captivated Argentina and ten of thirteen Presidents since have been Peronists.

In a nutshell, Peronism is premised on the creation of an authoritarian state which owns, or controls through extensive regulations, all meaningful levers of the economy (i.e., means of production). The justification for the power grab is that the politicians will use the power to negotiate better deals for the workers, and never to steal or gain unfair benefits for themselves or comrades.

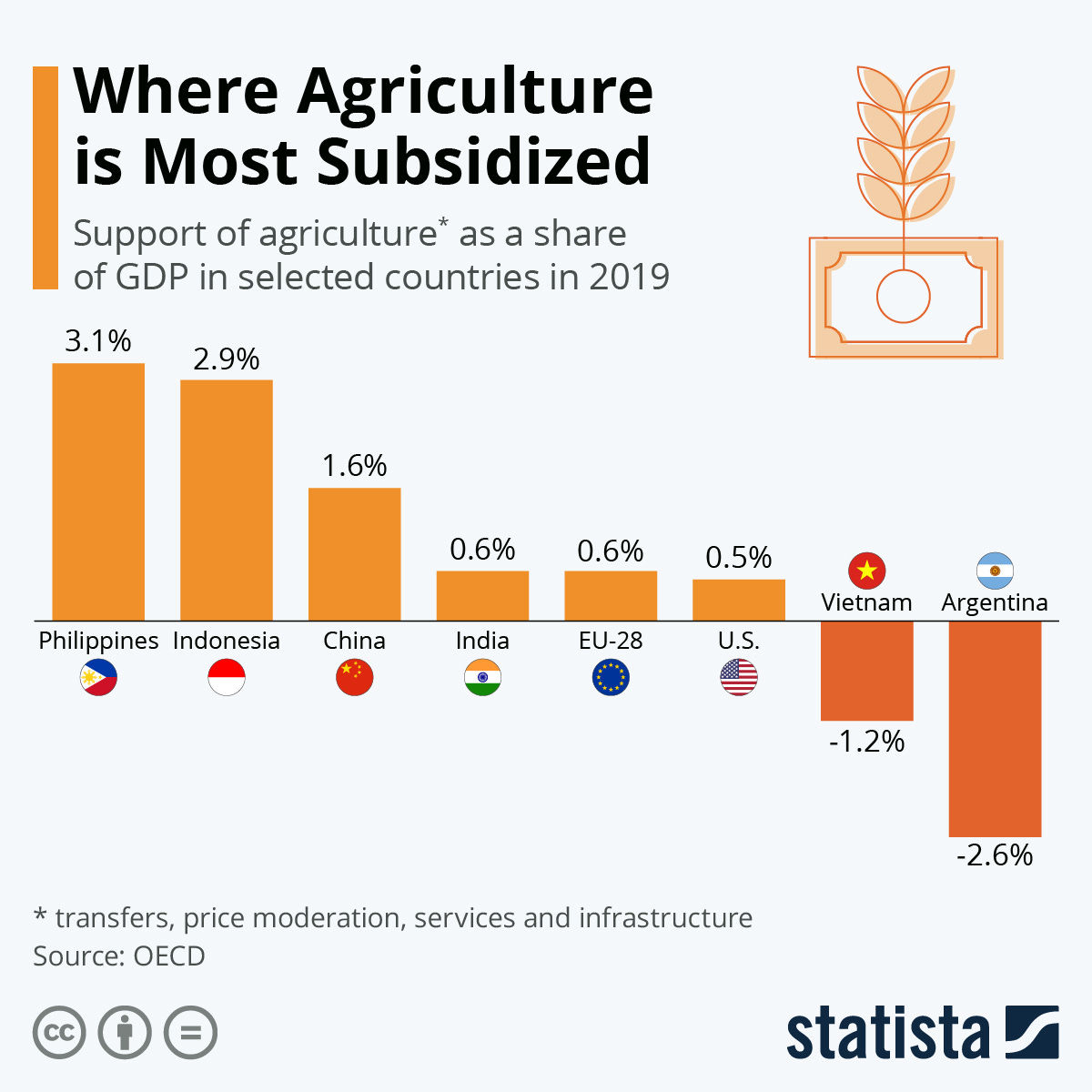

The “Peronism Trap” starts with severe market interventions, such as price controls. As of today, Argentina has around 1,300 government subsidized consumer goods price caps. The subsidies are costly with electricity price caps alone costing Argentinean workers ~4% of GDP annually. I say workers because only the workers suffer, sacrifice and pay under Peronism. The rich get richer and move their profits out of the country, and the idle poor elevated, protected and cash shoved in their pockets in exchange for obedience and votes.

When the government is no longer able to fund subsidies, it prints and borrows to continue the spinning of the merry-go-round. The incessant printing leads to persistent inflation and other maladies as we’ve seen pop up repeatedly in Argentina over the decades. Eventually, the unpaid producers stop producing, resulting in a further spiraling of more unemployment, poverty, and low productivity.

Besides the workers, the IMF has been a major financial supporter of Argentina’s governing incompetence. You should view the IMF as an accomplice in this case, not victim. It is no better than the barman who continues to serve drinks to the town drunk and permits him to drive home placing himself and others in grave danger. Sadly, the Peronists haven’t invested to improve the country or its infrastructure. Instead, they spend, borrow and print money to fund pensions, government wages (1/3 of total work force), and a multitude of failed social welfare programs (62% of budget).

Incidentally, America has a similar “FDR Trap”. If welfare isn’t eliminating poverty, then what is it doing?

Real Estate Impact

⛔ Argentina does not presently have a reliable real estate debt market given that inflation and interest rates exceed 100%. All-equity real estate transactions?

⛔ What is a valid cap rate to use to value a property in such a dysfunctional monetary and fiscal environment?

⛔ How do you value a local currency lease in Argentina? Dollar leases are possible, but exchange controls limit the ability to fully rely on dollar-denominated transactions and investors should expect difficulty repatriating profits.

⛔ Do you want a fixed real asset, that can’t be hidden or moved, wide open and exposed in a country animated by Peronist ideology?

Next Saturday: Why Argentina was born to be an exporting superpower. You made it through the “tough love” section of the series. Next week we reverse course and pat Argentina on the back.