Mexico Industrial Might be the Biggest Bubble in the History of LATAM Real Estate

The nearshoring data points don't match with the incessant hype. Let's take a look!

Bubbles in the investment world occur when a surge in asset prices is driven not by fundamentals, but instead by hype, wishful thinking, over-the-top headlines, and other unreliable determinants.

In this edition of the Emerging Real Estate Digest we present the arguments and data which tell a story that Mexico’s industrial valuations are too steep, not justified, and could be due for a severe and sustained correction.

United States-Mexico-Canada Agreement (“USMCA”)

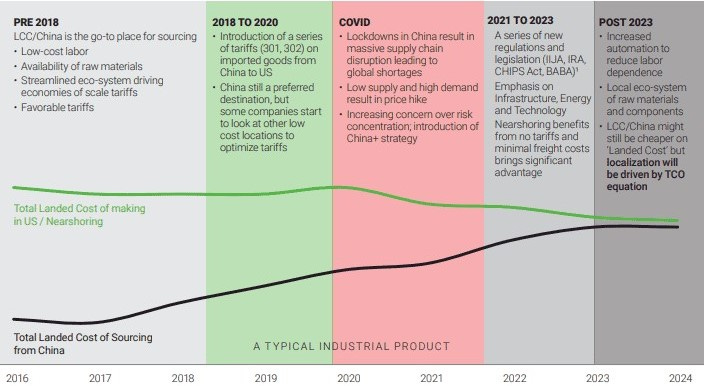

In 2017, Americans began for the first time collectively to question whether it was a good idea to be so reliant on China, its chief economic and geopolitical rival. As tensions have escalated, the national security concerns of China’s dominion of America’s supply chain have amplified.

Geopolitical dynamics are such that it now makes sense to move manufacturing from China, back to America, or to other strategic and allied nations. Costs have risen dramatically in China, as have shipping costs and times. In the early days of offshoring, as an example, a product that cost $90 assemble in America might cost $38 to assemble in Japan and less than $2.50 in China. The cost savings were too great to ignore, with payback periods of less than a year for the capital invested to establish the operation in China. By the early 2000s, nearly 70% of big box stores’ merchandise came from China.

The goal of the United States-Mexico-Canada Agreement (“USMCA”) was to replace and modernize the controversial and outdated NAFTA which had been in effect since 1994. Modernization of the North American alliance was required prior to beginning the decoupling process from China and rebuilding of new supply chains no longer in the grasps of the CCP and its agents.

Some of the important provisions of the USMCA for nearshoring in Mexico:

🚗 Cars and trucks with at least 75% (up from 62.5% under NAFTA) of the component parts manufactured in North America are sold free of tariffs. 40% - 45% of the work done on eligible vehicles must be done by workers earning at least $16 per hour.

🧠 Intellectual property protections increased to 70 years from 50 years under NAFTA.

🌅 Unlike NAFTA, USMCA sunsets if not renewed by mutual agreement in 16 years. Joint reviews occur every six years to renegotiate provisions given changed circumstances and global conditions.

👷 Labor standards allow factories which don’t meet workers’ rights standards to be excluded from the USMCA. This protects Mexican workers, and also encourages a more level playing field for American workers.

A handful of other policy measures support the USMCA’s aims. The Inflation Reduction Act incentivizes battery automobile manufacturing in North America. The Chips Act, and the Infrastructure Investment and Jobs Act, provide billions of funding for research and development in semiconductor manufacturing in America, and simultaneously hinder China’s access to critical semiconductor component parts.

FDI and Export/Import Flows

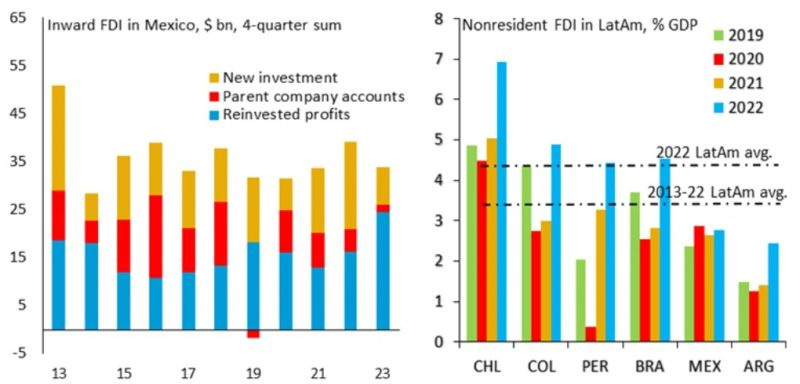

Data of FDI and export/import flows paint a picture of a stream and trickle of nearshoring investment and activity in Mexico, not a tsunami as the finance media loudly and often proclaims.

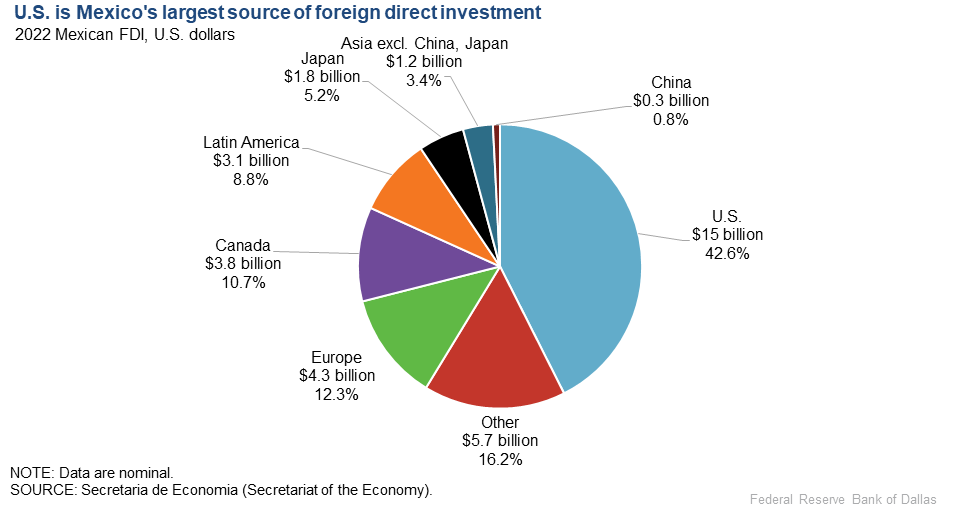

Let’s look at foreign direct investment (“FDI”). As a percentage of GDP, Mexico is receiving nearly the same amount of FDI as it always has. In 2023, most of the FDI has been from reinvestment of profits, not fresh capital entering the country.

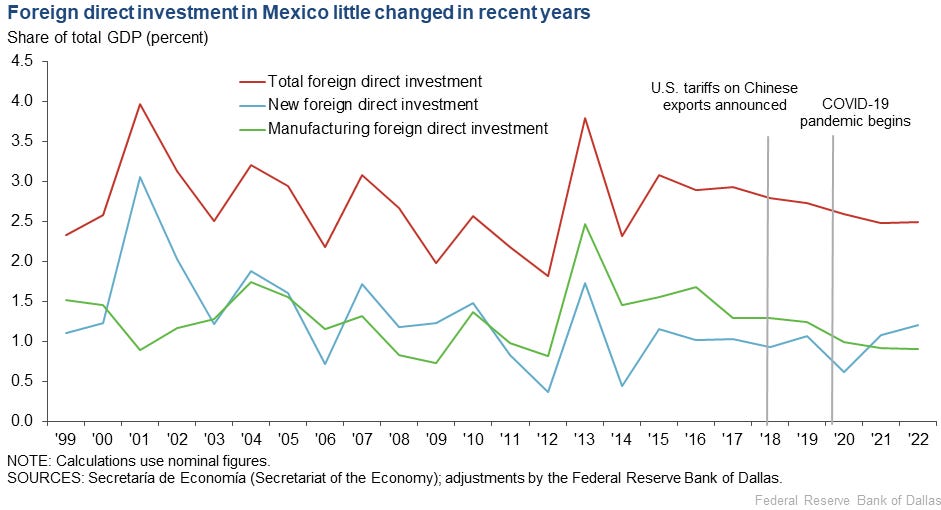

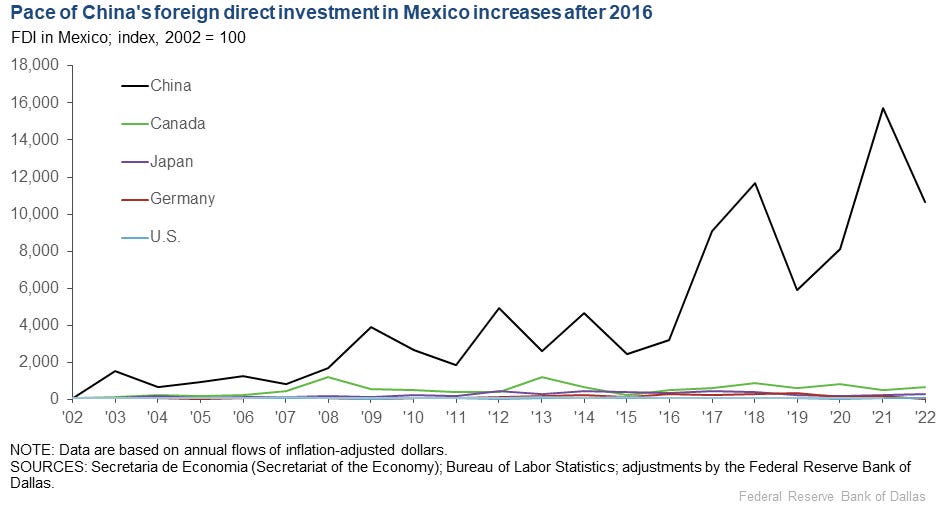

Here’s a chart from the Dallas federal reserve that presents the FDI data in a different manner. Manufacturing FDI has been decreasing in Mexico.

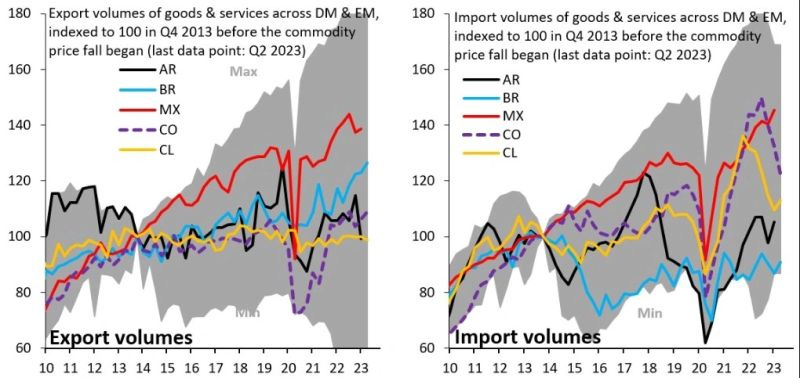

Export volumes from Mexico to America tell a similar story as inbound FDI flows. It’s business as usual. Imports into Mexico grew at a somewhat surprising rate and this is likely due to Chinese importation of materials and parts to assemble in Mexico in order to gain USMCA advantages. Does this business practice align with the spirit of the USMCA? Is there a risk for Chinese manufacturers that future USMCA provisions will be added looking into the ownership of the manufacturer, not just that the product came into America through Mexico?

FIBRA UNO, Mexico’s largest REIT, recently decided to spinout all of its industrial properties into a new REIT to be listed on the Mexican Stock Exchange. This new REIT will be the largest industrial REIT in Mexico and is a sign that FIBRA UNO believes it has done all it can to create value for its shareholders in Mexico’s industrial space. The move may also indicate FIBRA UNO agrees with Emerging Real Estate Digest that a correction is coming for industrial real estate in Mexico.

Chinese FDI Driving Modest Nearshoring Gains in Mexico

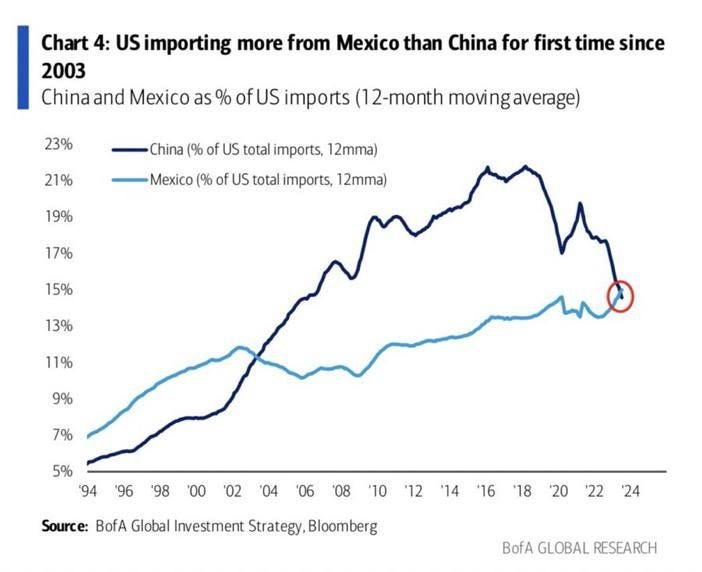

Last week your social media feed might have been inundated with pronouncements that Mexico had overtaken China as America’s #1 trading partner. While technically correct, it has less to do with anything Mexico is doing and more to do with shakiness in China.

The vast majority of the manufacturing leaving China is not coming to Mexico, it’s going home to America and to nations such as Morocco, Thailand, Indonesia, Vietnam, Turkey, Sri Lanka, Hungary, Czech Republic and more. Many of these countries have robust incentive schemes, and make frequent roadshows to America to entice them to invest in the respective country. Contrast this to Mexico’s President AMLO who has no coherent economic strategy and appears to many to be asleep at the switch (👇🏻 he wants to steal the food from and regulate that pigeon!).

🎤 Shannon K. O’Neill gives her expert opinion on nearshoring trends in Mexico and the rest of Latin America. She is a published author and the Vice President of Studies at Nelson and David Rockefeller and Senior Fellow for Latin America Studies at the Council on Foreign Relations (CFR).

China is the fastest growing supplier of FDI into Mexico. The usual FDI providers (e.g., America, Germany, Canada, Japan) are opting to not invest more into Mexico and holding steady.

China is coming from a low base and in absolute terms is still a small investor in Mexico compared to America. In nominal terms, China invested only $38 million in Mexico in 2011, which increased to $386 million in 2021, and slipped in 2022 to $282 million. In 2021, Chihuahua received the most Chinese investment, followed by Mexico City, and then Nuevo Leon.