Investor Spotlight: Paladin Realty Partners

An assessment, and interview with the CIO, of one of the most active real estate investors in Latin America over the last four decades.

In this edition of the Emerging Real Estate Digest we take a look at what is arguably the most experienced America-based multifamily investor in Latin America. The firm is Paladin Realty Partners (“Paladin”) and it has operated in Latin America since 1998. During that period, it has invested into 218 properties, containing 38,000 residential units, located in 7 countries, with project costs exceeding $5 billion.

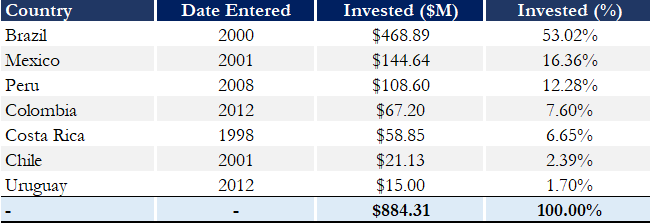

Paladin has made real estate investments in Brazil, Colombia, Mexico, Peru, Costa Rica, Chile and Uruguay. The nearly $900 million of invested capital was been mostly deployed in Brazil (53%), Mexico (16%) and Peru (12%). Paladin can invest in any real estate sector and country in the region, and today they are primarily focused on multifamily investments in Brazil, Mexico and the Andean Region.

Listen to the senior management team of Paladin as they describe the firm’s business model, history and differentiators.

Paladin Funds

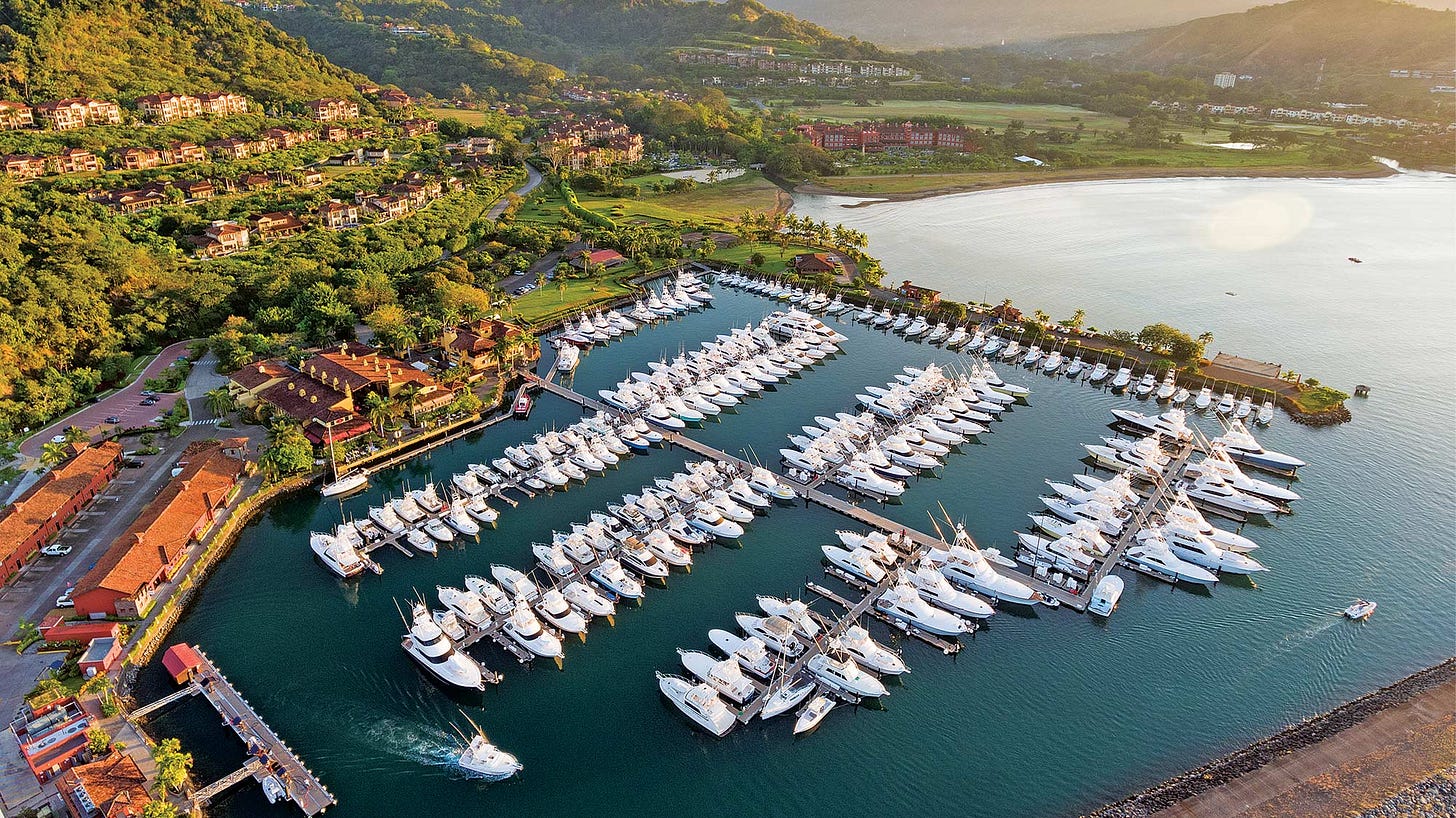

Since 1998, Paladin has raised six Latin America real estate funds with a collective AUM of nearly $1.4 billion. The first investment in Latin America was in the Los Suenos Resort and Marina in Costa Rica, a project Paladin still owns today.

Paladin’s first fund was named after its first investor, Bill Simon, who was a Treasury Secretary in the 70s and made a fortune as a pioneer in the leveraged buy-out industry in the 80s. From the success of this first fund, Paladin has been able to raise an astounding six additional funds for Latin America, an achievement few managers meet.

Over the years, Paladin has received investment from hundreds of institutional and family office investors.

Most of Paladin’s Latin American funds have included mandates to invest in multiple geographies. The one exception was the fourth fund which was mandated to invest only in Brazil.

CIO Discussion

Paladin’s Chief Investment Officer, Randall Loker, was kind enough to provide data and to answer the following questions exclusively for the readers of the Emerging Real Estate Digest.

(1) What have been Paladin’s biggest two challenges investing in Latin America?

Currency fluctuations – the one risk we cannot mitigate, that has been a big determinant of our dollar-based returns, is currency translation. Over the past decade it has been a painful slide across the region, but local currencies stabilized in 2021, and most have appreciated nicely in the last year.

Partnership issues – when we started in the business there were not a lot of large, sophisticated partners, and we ended up partnering with many local developers that we would never consider today. Many did not survive the inevitable cyclicality of the markets. The industry has matured dramatically over the past 20 years, and our partners today are better capitalized and have much stronger execution capacity.

(2) How has Paladin’s business model changed over the years?

We have become very local and very hands-on. In the early years we managed from Los Angeles, and relied exclusively on partners to execute the business. Today we have offices fully staffed with ex-developers in all of our major markets, who understand the equity risks in these investments, and in most cases co-develop the projects alongside our partners. We have never been better equipped to evaluate opportunities, or more versatile to execute development programs in the way that provides the best returns for our investors.

(3) Which will be the best LATAM real estate investment opportunities over the next 5 years?

Regionally: For-sale housing – still big housing shortages everywhere, proven time and time again to be the most resilient in all economic cycles.

Sao Paulo: Boutique Office – certain prime neighborhoods have super-low vacancy rates and you can build niche products to generate 10-12% unlevered yields on cost.

Mexico: Logistics – huge tailwind with the nearshoring trends; presents what looks like a long-term opportunity with dollar-denominated leases.

(4) What has to happen to attract more investors into LATAM real estate?

From a macro perspective, the region would attract a lot more capital by making important fiscal reforms, minimizing the amount of political instability, and demonstrating consistent economic growth. But realistically those things won’t happen overnight…and may never happen. However, for real estate investors, I don’t think all this is necessary. What is needed is for the risk/return dynamic to make sense relative to other investable markets. On the risk front, education would certainly help, as the project level economics are quite compelling when you understand the margins and the outsized demand; when we bring investors down to tour the region, they get it. On the return side, more funds need to round-trip compelling returns in USD. Track records in dollars just haven’t been strong enough to compete with opportunities in the US, and developed markets with less currency risk. As currencies have stabilized and have actually been appreciating, this should change, as the performance of the real estate won’t get washed away with devaluating currencies.

(5) The Biggest mistakes foreign investors make in LATAM?

As the late, great bossa nova musician Tom Jobin, once said, “Brazil is not for beginners.” I think too many investors expect things to work the way they do here in the states, and it makes for a rude awakening. More than just doing your homework, you need experienced locals on your side of the table with interests perfectly aligned to those of your investors.