Fairytale of Office-to-Residential Conversions

Converting underutilized offices to residential is difficult to pull off and in most cases cheaper to demo and build the apartment building from scratch.

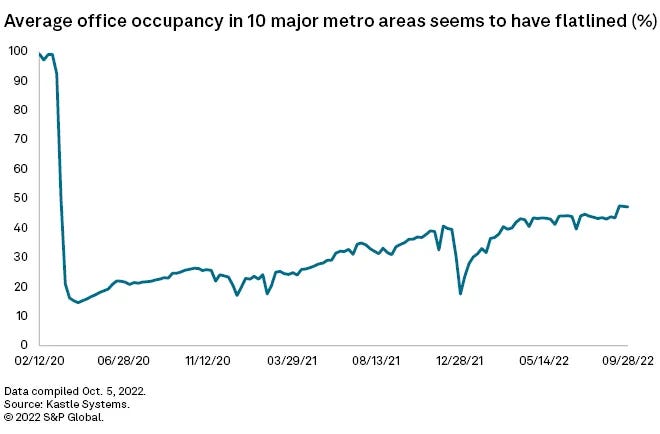

The remote working “fad” has contributed to diminished office valuations in major cities worldwide. Large American cities are faring the worst with new office leases being signed for 30% less space and valuations down nearly 50% from before the lockdowns. In those cities, only half of workers have returned to the office, and in tech job-heavy cities the figure is closer to 35%. Manhattan had 21.6% of its offices vacant in 2022, up from only 1.4% before the lockdowns.

Emerging Real Estate Digest has previously written on this topic: (1) Is Remote Work a “Bunch of Bullsh*t”?, and (2) The Remote Work Ship is Sinking.

The office-to-residential conversion narrative is simple and it is that converting underutilized offices to residential cleanly solves two problems simultaneously. These are cities having too much empty office space, and too few affordable and available residential units. Is it a good idea?

Let’s take a look.

Class A Office is Doing Fine

Real estate is all about location, location, location.

Most of the office buildings developers would like to convert to apartments are generally doing just fine. Prime properties have benefited from tenants deciding to downgrade their size requirements and upgrade to more desirable buildings and areas (i.e., “flight to quality”). Deals for office buildings in prime areas, at the “right” price, are far and few between.

What makes you think a bad office building will make a good apartment complex?

Construction Issues

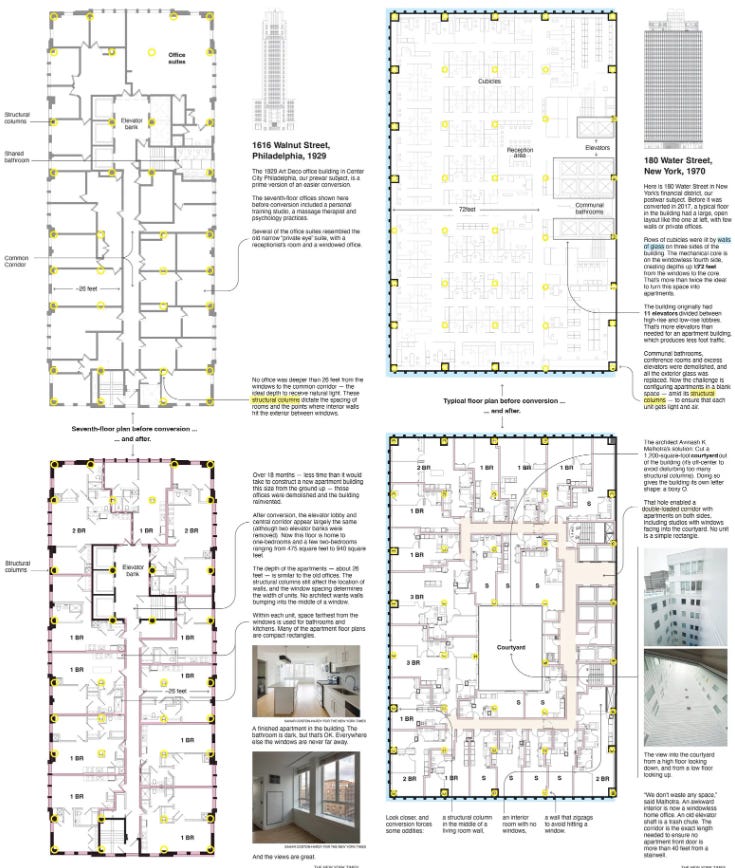

Pre-war office buildings are often selected for conversion because they have smaller floor plates. These buildings were built before air conditioning and fluorescent lights, making it necessary for each office tenant to have windows for lighting, ventilation, and cooling. This is exactly what you want for apartments, otherwise, the units in the interior will be cavernous and dark.

Old office buildings were built a while ago under different codes and when inspections were less rigorous. It’s not uncommon for these buildings to have structural integrity issues. Even with a thorough six-figure due diligence, at best 20% of potential defects aren’t discoverable until the building is cracked open and work begins. Budgets for office conversions are tight and can’t afford many landmines.

Office conversion architects must create layouts that include kitchens, bathrooms, and gathering areas within each unit. Amenities such as gyms and swimming pools might be required to entice residents. Facade and landscaping works provide curb appeal to take away “ugliness” and make the building marketable as a place to call home.

The new shell design must then be retrofitted with HVAC, mechanical, electrical, and plumbing systems suitable for residential uses. Codes differ between office and residential, the latter normally stricter.

It’s usually cheaper to demo the office and build from scratch.

Economics

Conversions require the developer to “thread the needle” and find a well-located building, at the right price, without major structural defects, which can be retrofitted at a reasonable price, and made marketable so units are leased or sold at prices high enough to pay back the bank and reward equity investors.

The hardest part of the developer’s job is achieving a low entry point on a qualifying building. A 2021 study by Moody’s Analytics found that only 3% of NYC offices were suitable for office-to-residential conversion. It found that office buildings purchased for more than $262/ft² in the city would struggle to profitably convert. Only 20% of all office transactions in the city traded hands at or below that figure. Most buildings in the 20% sample would have been in undesirable and potentially dangerous parts of the city. The median NYC office transaction price was $542/ft² in 2021.

Here are two examples, but there are many more, of points of friction that could stymie negotiations to acquire an office building to convert:

Offices usually generate rents on 100% of the building area, but residential charges on only 80%. Office tenants pay for common areas on a pro-rata basis, or it’s reflected in the higher rents associated with commercial uses. The buyer will want to pay only for the 80% he’ll use, and the seller will want to be paid for 100% of the space he’s handing over.

Office ceilings are usually 10% - 20% higher than apartment ceilings, and that can’t be adjusted in the conversion. The excess space isn’t valuable to the buyer but the seller isn’t going to give away 10% - 20% of the GLA.

Town Planning Challenges

Politicians proclaim they want office-to-residential conversions in their cities. I don’t doubt them, but I do know that everything changes as soon as applications for entitlements are submitted. Approvals are often won through adversarial processes, at great cost of cash and time to the developer.

Police and Other Services: an office node will have lighter policing requirements, and focused on daytime patrols. Conversely, residential areas often require heavier policing and more patrols after work hours. Similar impacts on the delivery of fire and electric services can arise.

Tax Abatements and Credits: it’s difficult to structure incentives so that just enough assistance is given, without going down the path of corporate welfare and crony capitalism. Real estate incentives tend to be longer-term (i.e., 10 years+) in nature which adds complexity. Most cities’ incentives will include a bundling of 10-year tax abatements, and historic and energy-efficiency tax credits and rebates to lure developers.

Amenities: parks, grocery stores, restaurants, and gyms may decide to close when their primary customers (i.e., daytime business shoppers) leave the city for their homes in the suburbs.

A Brookings study in Denver found that the city at the time needed around 25,000 additional housing units to meet demand, but that only 1,500 apartments could be generated from converting all empty offices to residential. The solution to the housing crisis will have to be solved with land outside of cities, not within.

My take: Office-to-residential conversions alone are not going to solve the problem of what to do with underutilized office buildings. A good rule of thumb is that between 3% and 5% of office buildings will qualify, but you still have to do the work within tight financial bumpers. Absent remote work abating, governments should be prepared to incentivize developers to convert empty offices and make entitling the project as hassle-free as possible. No amount of office conversions will solve the housing crisis, we can only hope to alleviate it in this way.