Emerging Markets Need Fed Rate Cuts Now

Until the federal reserve cuts rates emerging markets are left with few good options.

Investors with impressive track records are sounding the alarm that interest rates in America are coming down sooner than most think possible.

Barry Sternlicht, co-founder and CEO of Starwood Capital Group, recently shared his view that the fed will relent and lower rates soon because Western democracies can’t hang on much longer, and Washington DC is bleeding cash paying 5% on $33 trillion.

Bill Ackman is a billionaire hedge fund manager and this week he said the fed will cut rates in Q1 2024, and deeper and quicker than many are predicting. He believes cuts are necessary to avoid a hard landing caused by fixed debt repricing, and high real interest rates.

The impact of fed monetary policy on emerging economies is difficult to understate. When rates are low, emerging market debt and equities are relatively attractive, the converse being true when the fed turns hawkish. Emerging markets are stuck in a Mexican standoff with the fed and will continue to absorb damage until rates are lowered in the forms of (1) more costly debt obligations, (2) increased capital flight risks, and (3) higher costs for imported goods. Let’s take a quick look at these three implications.

Debt Repayments Harder

Most leaders of emerging economies gain power by promising to distribute more largess from the treasury to the voters than the last guy. These promises are almost impossible to stop and largely funded with dollar-denominated debt. As the fed increases interest rates, emerging market debt obligations become harder to meet due to depreciation and inflationary pressures on the local currency. The result is more local currency needed to purchase the dollars to service the debt.

This all happens because an increase in interest rates in America causes more capital to gravitate into the dollar given the safety associated with the world’s reserve currency. It’s difficult to find a better risk-adjusted investment return anywhere in the world beating the 5%+ investors achieve today holding dollars. The first assets to be liquidated to fund the dollar purchases are usually in the emerging markets. The sales result in domestic asset devaluations, currency depreciation, and inflation. The “spillover effects” are amplified by a deteriorating creditworthiness of the emerging market borrower, making other capital market interventions more expensive, at exactly the time when it most needs the capital.

Capital Flight Concerns

Emerging market economies are smaller and more fragile than their developed economy counterparts. Slight allocation cuts away from emerging markets by investors quickly add up and create capital flight issues including, but not limited to, local currency depreciation, asset devaluations, and ultimately inflation.

The standard response in the face of capital flight is to increase domestic interest rates to incentivize investors to keep their money in the emerging market. This response becomes problematic in cases where a global economic slowdown is also occurring. Cutting rates in those instances places the emerging economy at risk of economic contraction which can result in further capital flight.

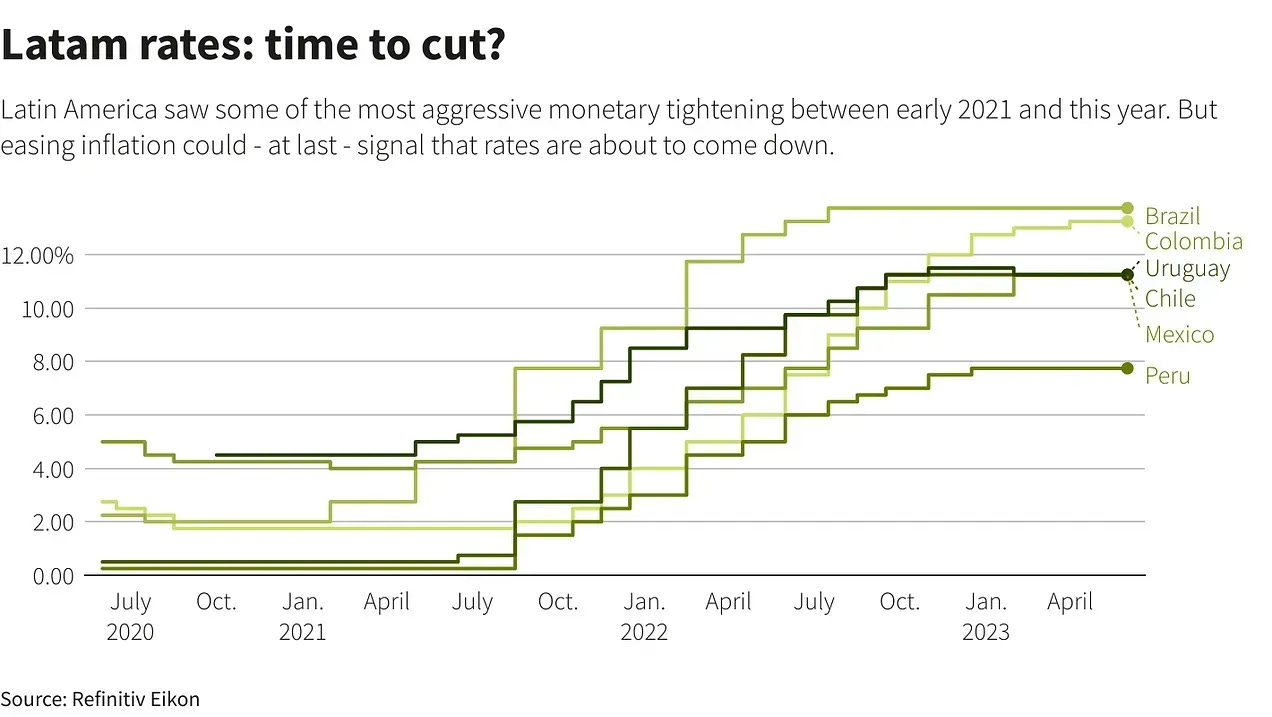

In the case of Latin America, rates were raised faster and harder than any other region in this cycle. Inflation in Latin America is largely under control, however the respective central banks are unable to cut rates without risking rapid currency devaluations, inflation and hits to the economies. Brazil is a bit of an outlier having made a couple substantial cuts, but its agriculture exports to China are booming, and much of its debt denominated in the local currency.

Higher Import Prices

40% of the global GDP is derived from the emerging markets, but they are the economies which can least afford price increases of energy, food, commodity and other consumer goods. Most of these items are priced in dollars and imported into emerging economies out of necessity. If they were produced domestically, the economy would be complex and wealthy and not classified as emerging. The same aforementioned principles apply and make the necessary imports more expensive for emerging market consumers and importers.

Some Good News

Emerging market capital inflows in November of 2023 were impressive, at least compared to what we’ve seen in 2022 and the rest of 2023. 2022 was one of the worse years on record for emerging market outflows. Investors are starting to believe that fed rates are coming down soon which is making emerging market equities and debt look more appealing.